Release Notes CCH iFirm Taxprep T3 2024 v.4.0 (2024.10.37.01)

New: Introducing Wolters Kluwer Support Platform

As part of our commitment to service, Wolters Kluwer is pleased to announce the launch of our new Support Platform.

Register to our Support Platform to submit, modify and track all your support requests in a single location. A chatbot system and a live chat feature powered by our virtual assistant are also included, with access to over 40,000 articles from our knowledge base. Note that since December 1, 2023, the Support Centre no longer offers an email support service, which has been replaced by our new support ticketing system.

If you need help during the registration process, please consult the following article to get all the information you need: How do I register to the new Support Platform?

Register now to our Support Platform and take advantage of all the benefits it has to offer!

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Taxprep

Welcome to CCH iFirm Taxprep, the first cloud-based professional tax software in Canada.

CCH iFirm Taxprep runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that CCH iFirm Taxprep is only supported on the Google Chrome and the Microsoft Edge (based on Chromium) Web browsers.

CCH iFirm Taxprep is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Taxprep version, consult the Technical Release Notes.

About CCH iFirm Taxprep T3

With CCH iFirm Taxprep T3, you have the most comprehensive collection of trust tax forms as well as tools designed to help you comply with requirements relating to the preparation of tax returns for trusts. CCH iFirm Taxprep T3 allows you to import data relating to beneficiaries in CSV format to speed-up data entry and reduce related input errors.

About

We are pleased to provide you with CCH iFirm Taxprep T3 2024 v.4.0. This version covers taxation years ending between January 1, 2023, and December 31, 2024, inclusive.

The rates applicable to the 2024 taxation year are those known as of May 31, 2024. Any changes resulting from subsequent federal, provincial and territorial announcements will be integrated into future updates of the program.

You can view the applicable rates by accessing the Table of Values Used in the Return found in the program.

Electronic Filing

Government requirements

The threshold for mandatory electronic filing of information returns for a calendar year has been lowered from 50 to 5 for information returns filed after December 31, 2023. For the latest information about the penalty for not filing information returns over the Internet, go to canada.ca/mandatory-electronic-filing.

Important dates for Internet transmission

The CRA has been accepting electronic transmissions of T3 and NR4 slips since January 8, 2024.

Revenu Québec has been accepting transmission of RL-16 slips since November 2023.

The CRA has been offering electronic filing of T3 returns through T3 EFILE since March 2, 2022. For updating purposes, the CRA closed the transmission service on January 19, 2024, and has been accepting the EFILING of T3 returns for the tax years 2023 and 2024 since February 19, 2024. For more information on this matter, please see the Federal – T3 EFILE article.

Rolling Forward Files

CCH iFirm Taxprep T3 2024 allows you to roll forward client files saved with Taxprep for Trusts (with the .322 or .323 extension), Cantax FormMaster (with the .T22 or .T23 extension) and version 2023.1 of ProFile (with the.22R extension).

The taxation year after a roll forward cannot end after December 31, 2024. If needed, it will be shortened so as to correspond to the period covered by this version.

Version 4.0 Content

RC312, Reportable Transaction and Notifiable Transaction Information Return

Following updates to the form, major changes took place within it. For example, the identification of the person required to disclose the return must now be indicated in Part 1. A custom question has been added before Part 1 so that the preparer can specify whether the trust is the person required to disclose a transaction, the person who obtains the tax benefit, or both. Also, it is now possible to use the return to disclose a notifiable transaction (Part 3) or a reportable transaction (Part 4).

The calculation of a late-filing penalty is now performed in Part 5, if applicable. Please note that the filing deadline is now 90 days after the time the person enters into the transaction or the time the person is contractually obligated to enter into the transaction, whichever comes first.

If you have completed this return using a prior version of the program, it is highly recommended that you review the return before filing it.

T3 Schedule 15, Beneficial Ownership Information of a Trust

The following modifications have been made:

-

An option has been added to the Type of trust section of the ID form to indicate whether the trust is a cemetery care trust or an eligible funeral arrangement trust. This option should be selected only when the chosen type of trust is 300, Other trust.

-

An option has been added to the Trustee(s) identification section of the ID form to indicate whether the trustee information entered in that form should be transferred to Schedule 15 or not. You can now select No if you do not want to transfer this information.

T3AO, Remittance Voucher – Amount Owing

Note: Please note that the T3AO remittance voucher is currently available in CCH iFirm Taxprep T3, but cannot be produced at this time. Production will be possible with a future version of CCH iFirm Taxprep T3.

The new remittance voucher T3AO allows a trust to make a payment to the CRA through a variety of payment methods. It can be used to make a payment in person at a Canadian financial institution or, for a fee, at a Canada Post outlet. The QR code printed on the remittance voucher contains all the information required to make a cash or a debit card payment at a Canada Post outlet. If the payment is sent by mail, the remittance voucher should be attached to a cheque or a money order payable to the Receiver General and sent to the following address: Canada Revenue Agency, P.O. Box 3800, Station A, Sudbury, Ontario P3A 0C3.

T776, Statement of Real Estate Rentals;

T2042, Statement of Farming Activities; and

T2125, Statement of Business or Professional Activities

The adjustment factors and percentages used to calculate UCC adjustments for accelerated investment incentive property (AIIP) and zero-emission vehicles (ZEV) are reduced for property acquired and available for use after 2023 and before 2028. Various changes have been made to custom Forms CCA Class 10.1, CCA Class 13 and CCA Other than Classes 10.1 and 13 of these three statements to identify the period during which the property is available for use. The appropriate factor can then be used to calculate the UCC adjustment for AIIP and ZEV.

For class 10.1, the UCC adjustment factor is determined based on the acquisition date entered.

For class 13, the lines Available for use before 2024 and Available for use after 2023 and before 2028 have been added to the Acquisitions subsection. These lines are calculated according to the start and end dates of the taxation year. When the taxation year overlaps two periods, a diagnostic will remind you to enter the acquisition amount for one of the periods. The acquisition amount for the other period will correspond to the difference between the total AIIP acquisitions and the amount entered for the first period.

For classes other than 10.1 and 13, the lines Available for use before 2024, Available for use in 2024 or 2025 and Available for use in 2026 or 2027 have been added to the Acquisitions subsection. These lines will calculate according to the acquisition date entered for each property recorded in the custom form Additions and Dispositions Workchart. Changes have also been made to the Classes 14, 14.1, 44 and 50 only subsection for property eligible for special accelerated depreciation rules in Québec. The line If “Yes”, enter the capital cost of this property has been renamed Available for use before 2024, and the lines Available for use in 2024 or 2025 and Available for use in 2026 or 2027 have been added.

Several general diagnostics have been added to help you complete these forms. If you completed one of these forms with a previous version of the program, we strongly recommend that you review Area A, Calculation of capital cost allowance (CCA) claim and the diagnostics before filing the T3 and TP-646 returns.

T1229, Statement of Resource Expenses and Depletion Allowance

Line Foreign resource expenses claimed has been added to Area III, Exploration and development expenses.

T2043, Return of Fuel Charge Proceeds to Farmers Tax Credit

On November 22, 2022, Environment and Climate Change Canada announced that the fuel charge program would expand to include Nova Scotia, Newfoundland and Labrador, Prince Edward Island and New Brunswick beginning July 1, 2023. As a result, Forms T2043 and T2043 WS have been updated to include new fields in each section to enter eligible farming expenses attributed to those designated provinces.

Furthermore, a section has been added to Form T2043 to calculate the provincial payment rates that the trust claiming the return of fuel charge proceeds to farmers tax credit must use. These rates can differ when the taxation year starts in 2022 or ends in 2024.

The new section shows the number of days of the taxation year included in the relevant calendar years. As a result, the portion of the taxation year included in the calendar years is calculated and used to obtain accurate payment rates on Forms T2043 and T2043 WS.

TPF-1026.0.1.P, Remittance Slip

Note: Please note that the TPF-1026.0.1.P remittance slip is currently available in CCH iFirm Taxprep T3, but cannot be produced at this time. Production will be possible with a future version of CCH iFirm Taxprep T3.

The new remittance slip allows a trust to pay its balance due through the online services offered by its financial institution. The trust should use the slip with the payment code if the institution allows it. Otherwise, it can use the other options offered by the institution. Remittance slips can also be printed and used to pay the balance by mail. Please note that, for 2023, the TPF-1026.0.1.P slip is optional, but recommended to allow the trust to make a payment electronically and without delay. For the 2024 tax year, the payment slip will be officially implemented in Revenu Québec’s procedures.

Version 4.0 – Corrected Calculations

The following problem has been corrected in this version:

Federal

Version 3.0 Content

MR-14.A, Notice Before Distribution of the Property of a Succession

Following an update of the form, line 97 has been added to report post-death income from an FHSA.

T3 Schedule 15, Beneficial Ownership Information of a Trust

The following improvements have been made to Schedule 15:

-

When a beneficiary is a non-resident, the beneficiary’s Canadian tax identification number will be transferred to the corresponding entries on Schedule 15. The foreign tax identification number will only be transferred if no Canadian tax identification number is entered on the Beneficiary Information form.

-

A diagnostic has been added as a reminder to answer the following question to make Schedule 15 applicable: Is the trust a cemetery care trust or an eligible funeral arrangement trust?

TP-646, Trust Income Tax Return

The following improvements have been made to the TP-646 return:

-

A checkbox has been added to section 5, Additional information about the trust, to indicate whether information from Schedule 15 should be transferred over or not. If the trust is exempt from the requirements to provide additional information, you may check this box to prevent information from being transferred from Schedule 15.

-

Lines 2a, Last name of trustee or liquidator of the succession (if the trustee or liquidator is an individual), 2b, First name, and 2c, Name of trustee or liquidator of the succession (if the trustee or liquidator is not an individual), are now calculated based on whether the trustee is an individual or not.

-

A diagnostic has been added as a reminder to override the identification number when it is transferred from Schedule 15. An override is required to enter the identification number of any entity other than beneficiaries. The correct Québec identification number will be carried over for beneficiaries who have been entered on the BENEF form.

T3PEMJ, Prince Edward Island Tax (Multiples Jurisdictions)

Several changes have been made to this form for a taxation year ending in 2024. For more information, please refer to the release note for Form T3PE, Prince Edward Island Tax, in the Version 2.0 Content section.

Version 2.0 Content

T3PE, Prince Edward Island Tax

In its budget tabled on May 25, 2023, the Government of Prince Edward Island announced the addition of two tax brackets and the abolition of the surtax for the 2024 and subsequent taxation years. Therefore, the tax brackets for Graduated Rate Estates (GRE) and Qualifying Disability Trusts (QDT) will be the following:

|

Tax brackets |

Rates |

|

$32,656 or less |

9.65% |

|

More than $32,656 but not more than $64,313 |

13.63% |

|

More than $64,313 but not more than $105,000 |

16.65% |

|

More than $105,000 but not more than $140,000 |

18% |

|

More than $140,000 |

18.75% |

As for the tax rate for trusts other than GRE and QDT, it has been increased from 16.7% to 18.75%. In addition, the credit rate for donations of $200 or less has been adjusted to 9.65% and the rate for donations over $200 has been adjusted to 18.75%.

Version 2.0 – Corrected Calculations

The following problem has been corrected in this version:

Federal

Version 1.0 Content

Government requirements

Since January 1, 2024, payments or remittances to the Receiver General for Canada should be made as an electronic payment if the amount is more than $10,000. Payers may face a penalty unless they cannot reasonably remit or pay the amount electronically. For more information, go to canada.ca/payments. Revenu Québec has introduced identical government requirements.

Deleted Forms

-

TP-646.G, Additional Information – Trust Resident in Québec That Owns a Specified Immovable

Modifications and additions

Trust Identification and Other Information

The Additional information for roll forward subsection has been added to the Taxation yearinformation section of the Identification form. This new section allows the next year-end to be entered if the next tax year is shortened. Therefore, this year-end will be used when rolling forward the file. Before rolling forward your file, make sure you are using a version of CCH iFirm TaxprepT3 that supports this year-end.

Preparer Profiles – EFILE Tab

The EFILE tab has been added to the preparer profile and can be consulted at any time. The EFILE Information subsection that was in the Profile tab has been transferred to the new EFILE tab to facilitate navigation and data entry in the preparer profile. The boxes for the electronic transmission of the T3D, T3GR, T3P, T3RI and T1061 returns have also been added.

EFILE, Electronic Filing

New restrictions have been added that exclude certain trusts from the electronic filing service. Trusts that declared bankruptcy during the year, as well as trusts that filed Form T2223, Election Under Subsection 159(6.1) of the Income Tax Act by a Trust to Defer Payment of Income Tax, are now ineligible for EFILE. Diagnostics have also been added to guide the tax preparer.

However, it is now possible for a trust filing an income tax return under section 216 of the Income Tax Act to transmit its return electronically via EFILE. A mandatory question has been added to section Questions used for EFILE only of the Trust Identification and Other Information form to determine the type of election made by the trust.

T3, Trust Income Tax and Other Information

Questions 13 and 14, related to the new Schedule 15, have been added to section Answer the following required questions. Line 68, Yukon mining carbon price rebate, has also been added.

T3 Schedule 15, Beneficial Ownership Information of a Trust

In the 2018 Budget, the government announced new reporting requirements for trusts. On December 15, 2022, Bill C-32, which includes the legislation that supports this measure, received Royal Assent. As a result, Schedule 15 was added to fulfill the new reporting requirements.

The following modifications have been made to the Beneficiary Information form to assist with completing Schedule 15:

-

Fields have been added for the beneficiary classification.

-

A field has been added to exclude the beneficiary from disclosure on Schedule 15 if the beneficiary’s information is subject to solicitor-client privilege.

-

A field has been added to indicate if another type of reportable entity is applicable to the beneficiary and transfer the beneficiary’s information to the appropriate section on Schedule 15.

-

A field has been added to indicate that the beneficiary ceased to be a reportable entity during the year. The beneficiary will be deleted when rolling forward to next year.

-

A field has been added to indicate whether the beneficiary information was transferred to the CRA in a prior year.

You can refer to FAQ FT32023-003 for more information on Schedule 15 and how to file it.

T3APP, Application for Trust Account Number

Several changes have been made to this form, including:

-

The line Your language of correspondence has been removed from the form.

-

Step 3, Address, as been removed. You must now indicate the address in Step 2, Primary trustee contact information, under option 1 if the trustee is an individual or under option 2 if the trustee is a non-individual.

-

The line The mailing address is the same as the address in Step 2 is now displayed on screen only, in Step 3 – Mailing address.

-

In Step 4, Additional trust information, you must answer the new question Select the type of trust from the drop-down menu and indicate the Date the trust was created. This date is updated with the answer to the custom question Date trust was created in section Type of trust of Form ID. It is now possible, by selecting the appropriate box, to indicate that you are registering a non-resident trust solely for the purpose of filing certain special elections or returns.

If you have completed this form with a previous version of the program, it is recommended that you revise the content before filing it.

T3-DD, Direct Deposit Request for T3

The list of banking institution numbers has been updated and several changes have been made. If a withdrawn code has been entered in box 351 of the form, it will be deleted. In all circumstances, it is advisable to validate the banking information before filing this form.

T3F, Investments Prescribed to be Qualified Information Return

Due to a building refit spanning multiple years, the Registered Plans Directorate’s mailing address has been temporarily changed. Please use the following address to file your T3F return and for all correspondence until further notice:

Registered Plans Directorate

Canada Revenue Agency

2215 Gladwin Crescent

Ottawa ON K1B 4K9

T3D, T3D Income Tax Return for Deferred Profit Sharing Plan (DPSP) or Revoked DPSP;

T3GR, Group Income Tax and Information Return for RRSP, RRIF, RESP, or RDSP Trusts;

T3P, Employees' Pension Plan Income Tax Return;

T3RI, Registered Investment Income Tax Return; and

T1061, Canadian Amateur Athlete Trust Group Information Return

Several changes have been made to these forms, including:

-

You must now indicate whether the trustee is an individual (option 1) or a non-individual (option 2) and provide only the corresponding information in the Trustee information section.

-

The custom question Has the name of the trustee changed since the last time the CRA was notified? has been added to the Trustee identification section, on screen only, as the answer to this question is mandatory for electronic transmission only.

-

The question Did the trust also file a related T3RET, T3 Trust Income Tax and Information Return? has been added, excluding the T1061 return, to the Information about the trust section. If the answer to this question is Yes, you will need to provide the related trust account number.

-

Line 102, Refund code, has been added.

-

For the T3RI return only, columns c) to g) have been added to the table in Area A of Schedule 2.

-

For the T1061 return only, beneficial ownership questions have been added to determine if you are required to complete a Schedule 15, Beneficial Ownership Information of a Trust.

If you completed one of these forms with a previous version of the program, we recommend that you review the content before filing them.

T3MB, Manitoba Tax

Line 14, Manitoba recovery tax, has been removed from the form.

T3QDT-WS, Recovery Tax Worksheet

Line 32, Gross-up amount of dividends attributable to taxable income later distributed to an electing beneficiary, has been added to Part 2, Provincial or territorial recovery tax calculation. As a result, subsequent lines have been renumbered. In addition, line 40, Provincial or territorial tax previously paid attributable to taxable income later distributed, will no longer be calculated if the province is Alberta.

T2000, Calculation of tax on agreements to acquire shares

It is now possible to electronically transmit the T2000 return at the same time as the T3D, T3GR and T3P returns. Note that if the return is applicable, it will be electronically transmitted automatically.

T2125, Statement of Business or Professional Activities

The custom lines Electricity, heating and water and Telephone and utilities have been added to break down the amount of line 9220, Utilities.

If you completed this form with a previous version of the program and an amount was entered on line 9220, this amount will be transferred to the custom line Telephone and utilities.

TP-80, Business or Professional Income and Expenses

Several changes have been made to this form, including:

-

Line 122, Work in progress at the beginning of the fiscal period, has been removed. The amount entered on line 3N, WIP at the start of the year, of Form T2125 will be added to line 110, Sales, commissions or professional fees, of Form TP-80.

-

Line 239, Electricity, heating and water, has been added.

TP-646, Trust Income Tax Return

Several changes have been made to this form, including:

-

The line 2b.1, Date of birth of trustee or liquidator of the succession (if the trustee or liquidator is an individual), has been added.

-

The line 13b, The date the trust became resident in Canada, and line 13c, The date the trust stopped being resident in Canada, have been added.

-

A table has been added after question 32 to indicate details if a personal trust holds shares in one or more private corporations.

-

Part 5 (previously Part 6), Additional information about the trust, is now required for all trusts with a year-end after December 30, 2023, except where certain exemptions apply. Please refer to section 4.5 of the guide for more information. As a result, the information required in Part 5 will be calculated based on information entered on Schedule 15 of the federal return.

-

The information about the person who completed the return has been moved to Part 6 of the form. The province has been modified to a drop-down list and is no longer calculated based on the T3 RET form, but from the preparer profile instead.

TP-1086.R.23.12, Costs Incurred for Work on an Immovable

Following the update of the form, section 1, Information on the payer, has been modified. Furthermore, the Province field has been added to section 2, address of the immovable.

Where to Find Help

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

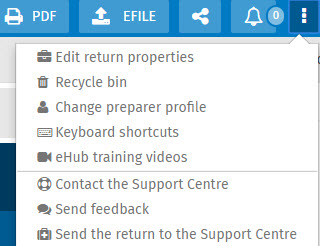

To access the Help or to submit a suggestion or idea regarding the product, click the following icon in the top right portion of the screen: