Internal information for the preparer

The box Preparing a personal income tax return for at least one recipient allows the preparer to indicate that the client file contains at least one recipient of a slip/RL slip for whom he or she is preparing a personal income tax return.

The fields “Tax Preparer’s Profile used,” “Personalized identification number,” “Client code,” “Partner,” “Discounted T1,” “Preparer,” “Discounter’s code,” “Reviewer,” “Date needed,” “Assigned to” and “Delivery method,” at the top of the form, are only provided to help you manage tax returns. This is not information required on the paper return or information that will be transmitted with EFILE. Note that the name in the “Partner” field is kept at all times when rolling forward data. However, the names in the “Preparer,” “Reviewer” and “Assigned to” fields will not be kept if the check boxes Keep the reviewer’s name, Keep the preparer’s name and Keep the field “Assigned to” have been cleared under Roll Forward/Data Options in the Options and Settings dialog box.

If you are using the staff list from the preparer profile, note that the names will be rolled forward when the preparer profile is converted and this preparer profile must be rolled forward first in order for the names to be rolled forward as well in the client file.

Using preparer profiles to create a list of staff members

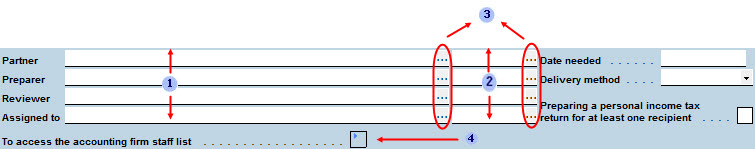

You may now create a list of the accounting firm staff to make it easier to manage the “Partner,” “Preparer,” “Reviewer” and “Assigned to” fields.

|

The names of the staff members selected for the “Partner,” “Preparer,” “Reviewer” and “Assigned to” fields will display in these fields. |

|

The identification numbers of the staff members for the “Partner,” “Preparer,” “Reviewer” and “Assigned to” fields will display in these fields. |

|

Click these buttons to access the list of names or identification numbers of staff members who are assigned the roles of “Partner,” “Preparer” and “Reviewer,” as well as the general list accessible using the “Assigned to” field in the preparer profile used and in the customized list described at point four. You may create separate lists for each of the three roles. As for the list of the “Assigned to” field, it contains the first and last names of all persons in the list of the accounting firm staff in the preparer profile and in the customizable list described at point four. |

|

Double-clicking this expand box will allow you to access the List of the Accounting Firm Staff form. The names of the accounting firm staff entered in the list in the preparer profile will be displayed, but cannot be modified. However, if the check box Allow customizing the list using Form Client Identification and Other Information has been selected in the preparer profile used, you may add names to the list. Note that the names of staff members added in that section are only accessible in the active client file and are not added to the master list in the preparer profile.

|

Note: Using the list of the accounting firm staff in this section of the form will not be possible if no preparer profile has been converted or created.

Provincial and State Two-Letter Codes

|

AB Alberta BC British Columbia MB Manitoba NB New Brunswick NL Newfoundland and Labrador NS Nova Scotia NT Northwest Territories |

NU Nunavut ON Ontario PE Prince Edward Island QC Quebec SK Saskatchewan YT Yukon Territories

|

|

AL Alabama AK Alaska AR Arkansas AZ Arizona CA California CO Colorado CT Connecticut DE Delaware DC District of Columbia FL Florida GA Georgia HI Hawaii ID Idaho IL Illinois IN Indiana IA Iowa KS Kansas KY Kentucky LA Louisiana ME Maine MD Maryland MA Massachusetts MI Michigan MN Minnesota MS Mississippi MO Missouri |

MT Montana NE Nebraska NH New Hampshire NJ New Jersey NM New Mexico NY New York NV Nevada NC North Carolina ND North Dakota OH Ohio OK Oklahoma OR Oregon PA Pennsylvania RI Rhode Island SC South Carolina SD South Dakota TN Tennessee TX Texas UT Utah VT Vermont VA Virginia WA Washington WV West Virginia WI Wisconsin WY Wyoming ZZ Other |

See Also