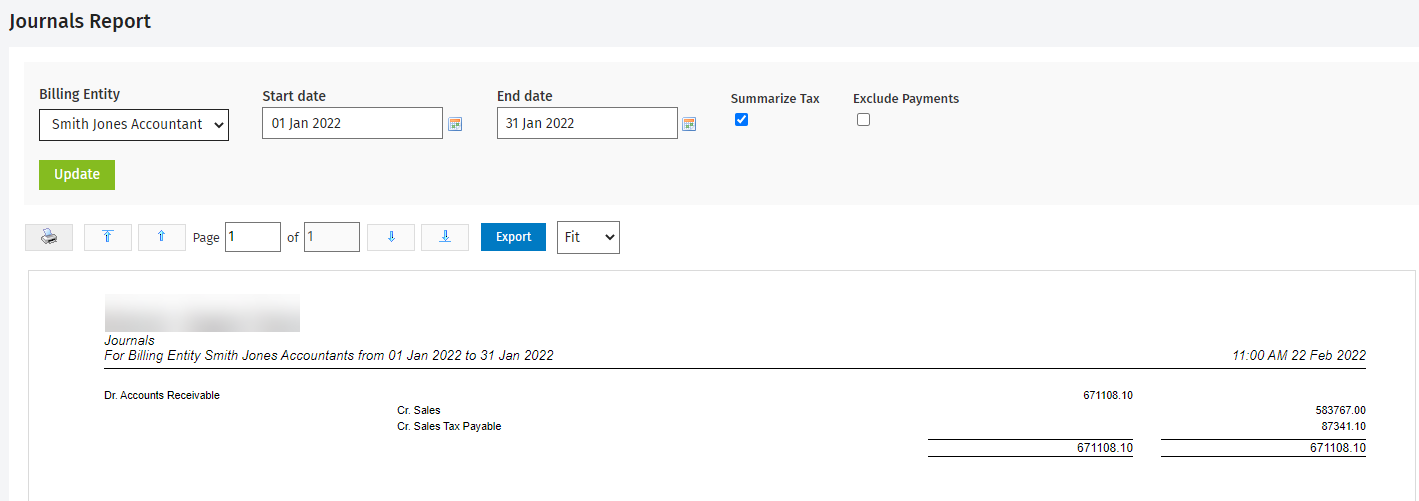

Journals Report

Receivables - View Only, or

Receivables - View, Add and Edit Transactions

You can use this report to help you add journal entries to your separate accounting system. The amounts displayed in the report are calculated using your accounts receivable data.

The Summarize Tax check box is selected by default, which means that the total of all tax types is displayed in a single row (Sales Tax Payable) in the report. If you clear this check box, a row is displayed for each tax type used during the selected period.

The Exclude Payments check box is NOT selected by default. You should select this check box if you want to include accounts receivable payments in the report calculations.

Click here to learn more about using reports.