Print forms and tax returns to PDF

Tax - Print to PDF

Printing forms and tax returns can be done directly from the CCH iFirm Taxprep module, allowing you to create digital documents that are easily accessible in PDF format.

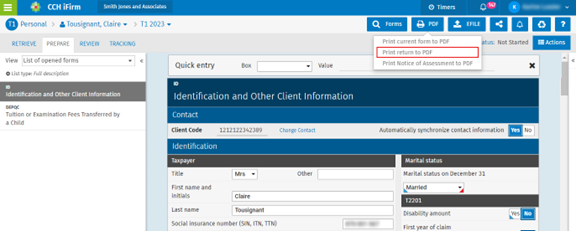

Print a current form to PDF

To print the current form on the screen, proceed as follows:

-

Choose the relevant product, then select the return.

-

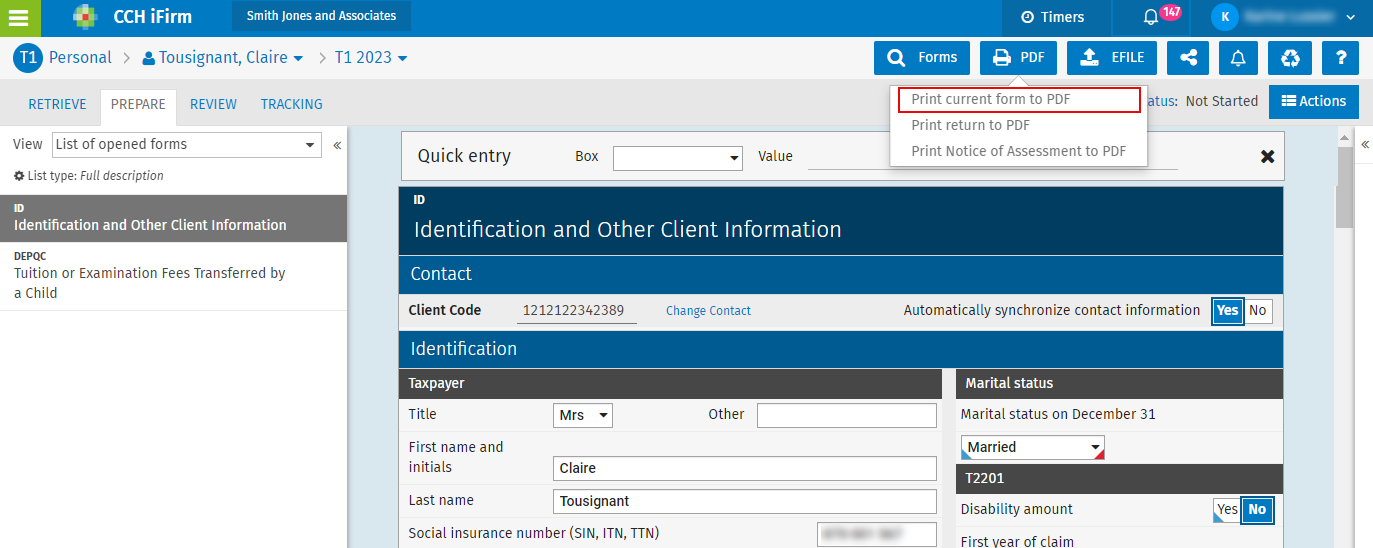

From the PREPARE tab, select the form that you want to print. You can also perform a search by clicking the Forms button.

-

Click the PDF button at the top right corner of the screen, followed by Print current form to PDF.

-

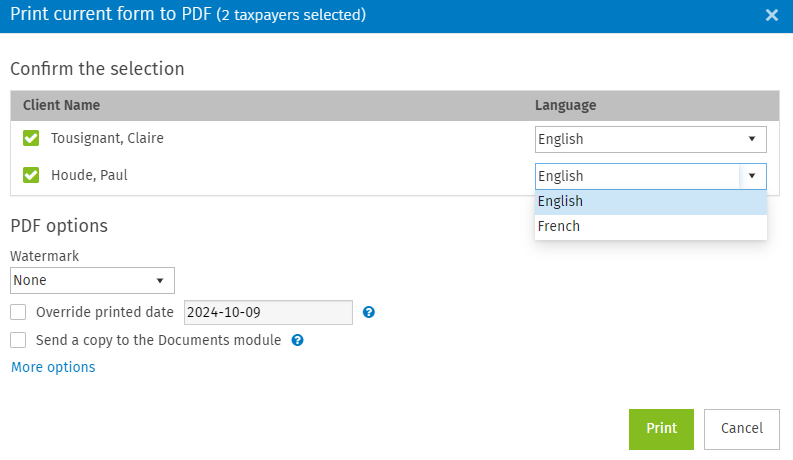

Select the family members for which you want to print the form and choose English or French in the Language drop-down list.

-

If a watermark must be added to the form to be printed, select the relevant option in the Watermark drop-down list.

-

Select the Override printed date check box so that a date other than today’s date is displayed on the form.

-

Select the Send a copy to the Documents module check box if you wish to upload the documents in the tax folder of the current year of the contact(s).

Note: You can choose additional printing options by clicking More options. Select or clear the relevant check boxes and click Save.

-

If you have multiple associated clients and wish to merge all forms of each family member into a single PDF file, select the Merge PDF files into a single file check box.

-

-

Click Print. The printing process will begin in a new window of the web browser.

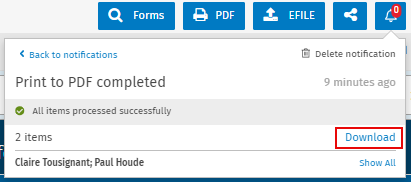

-

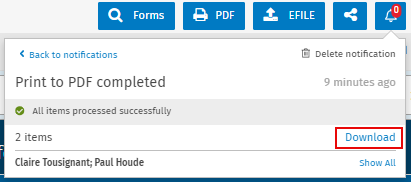

You can also access your PDF file directly from your notifications by clicking the

icon, then by selecting the element and clicking Download.

icon, then by selecting the element and clicking Download.

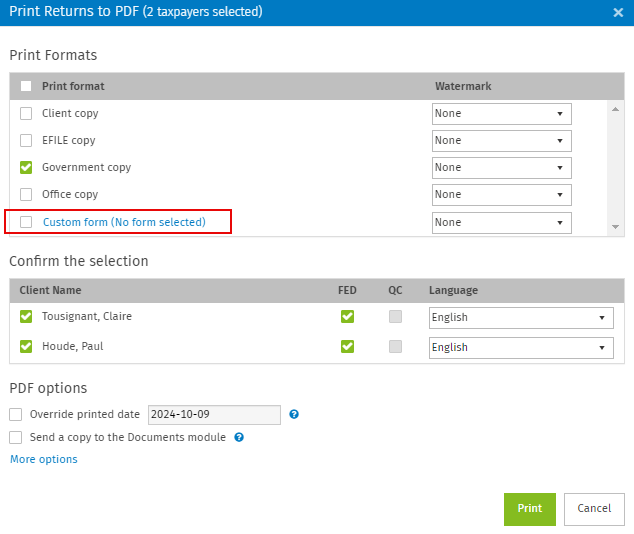

Print a tax return to PDF

To print a tax return, proceed as follows:

-

Choose the relevant product, then select the return.

-

Click the PDF button at the top right corner of the screen, followed by Print return to PDF.

-

Select the relevant print formats in the Print Formats section.

Tip: The Custom form model allows you to select specific forms to be printed. You can customize your print formats to specify which forms should be included.

-

Select the family members for which you want to print returns and confirm if both federal and provincial returns must be printed. Then, choose English or French in the Language drop-down list.

-

Modify the print options according to your preferences by clicking More options.

-

Click Print. The printing process will begin in a new window of the web browser.

-

You can also access your PDF file directly from your notifications by clicking the

icon, then by selecting the element and clicking Download.

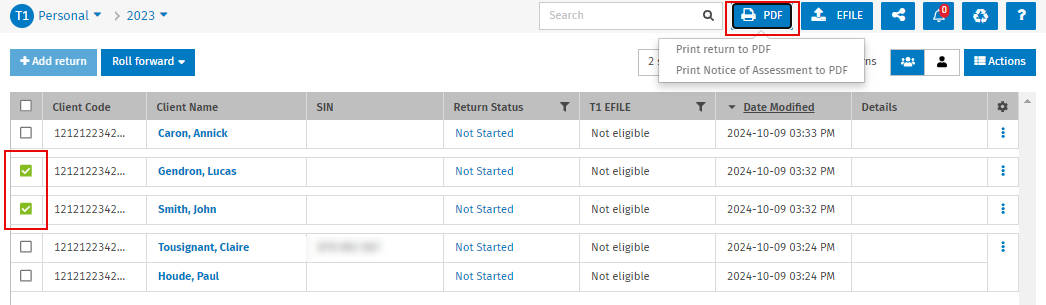

icon, then by selecting the element and clicking Download. Note: You can print multiple tax returns at once from the return manager. Select the relevant returns, click the PDF button, followed by Print return to PDF.

Note: You can print multiple tax returns at once from the return manager. Select the relevant returns, click the PDF button, followed by Print return to PDF.

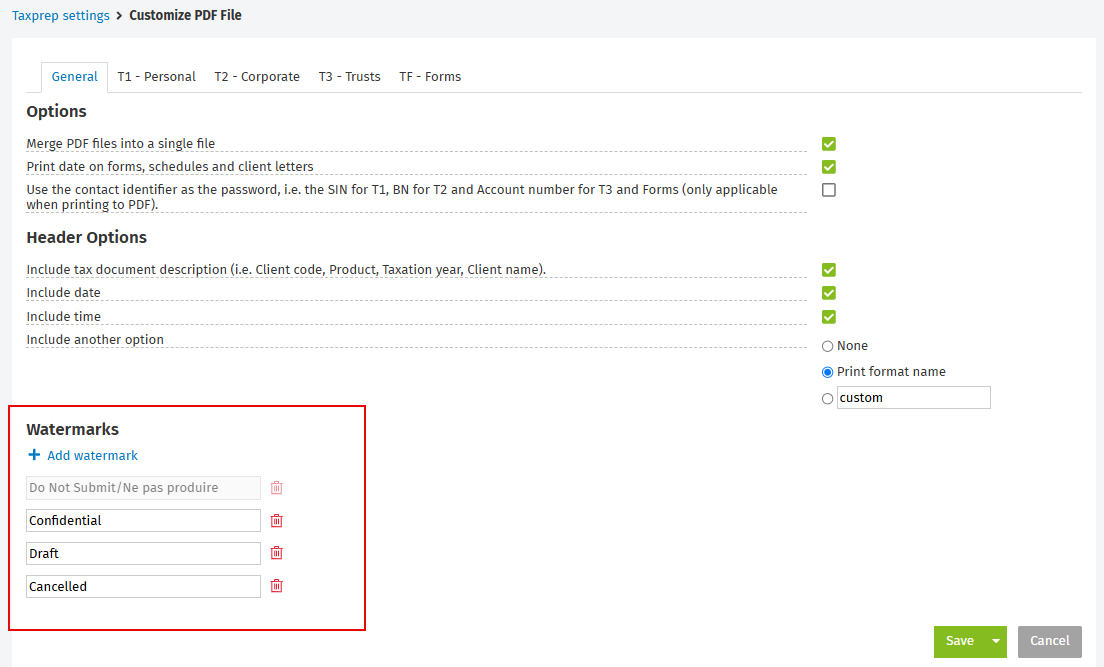

Watermark

Tax - Settings - Customize PDF File

You can decide to include a watermark in the forms and returns in PDF format that you are printing.

To add a watermark or to change an existing watermark, proceed as follows:

-

Click Settings, followed by Taxprep and Customize PDF File.

-

From the General tab, click Add watermark, then enter the desired name. You can also modify the name of an existing watermark.

-

Click Save to confirm.

Note: The Do Not Submit/Ne pas produire watermark cannot be deleted nor modified.

Note: The Do Not Submit/Ne pas produire watermark cannot be deleted nor modified.

Print options

For each product, several print options can be selected or cleared by clicking More options in order to customize your documents to be printed.

|

Product |

Description |

| T1 - Personal |

|

|

T2 - Corporate |

|

|

T3 - Trusts |

|

|

TF - Forms |

|

For each product, you can select or clear the following header options:

-

Include tax document description (Client code, Product, Taxation year, Client name)

-

Include date

-

Include time

-

Include another option

-

Mask SIN in header and footer (T1 – Personal only)