Download tax data

Downloading tax data allows you to retrieve tax data directly from Revenu Québec, optimizing the preparation of tax returns.

Pre-existing information and slips can be imported using CCH iFirm Taxprep to complete a T1 – Personal return.

Content

Download T1 tax data

Tax – T1 – Returns – Import CRA/RQ Data

To download an individual's tax data for the current year, proceed as follows:

-

Select the individual concerned by the return in the return manager.

-

Click the RETRIEVE tab, then click Download in the Revenu Québec Tax Data Download service section.

Note: To download tax data, the electronic services for Québec must be fully set up in the user’s settings.

-

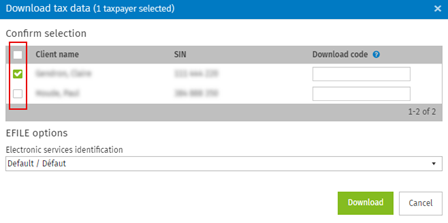

Select the family members for which you want to auto-fill the return, then click Download.

-

In the Electronic services identification drop-down list of the EFILE options section, you can select your identification information for electronic services.

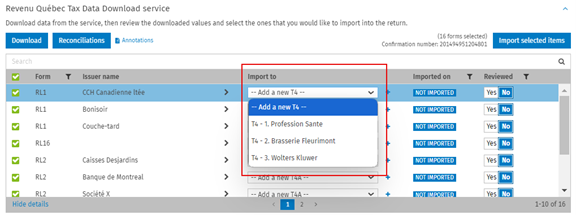

- Select the items that you want to import, such as slips and tax instalments, then click Import selected items.

Note: You can link a slip from the new taxation year to a slip from the previous year. Select the corresponding slip, and in the Import to drop-down list, choose the relevant slip. Repeat this step for each slip concerned.

Note: For each family member that was previously selected, click Import selected items in the return of the individual.

-

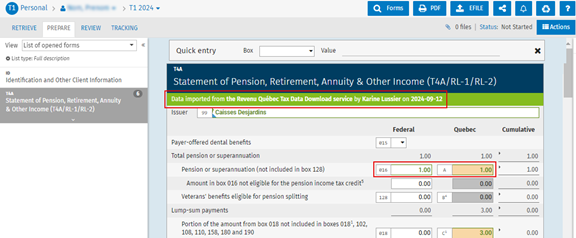

Once all the items have been imported, click the PREPARE tab to see the information. Click the

button to access the forms. The fields that have been modified due to the import will be displayed in green in the forms.

button to access the forms. The fields that have been modified due to the import will be displayed in green in the forms.

Slips available for download

Here is the list of available slips relating to the downloading of tax data for your tax return.

|

Slips |

Description |

|

RL-1 |

Employment and Other Income |

|

RL-2 |

Retirement and Annuity Income |

|

RL-3 |

Investment Income |

|

RL-5 |

Benefits and Indemnities |

|

RL-6 |

Québec Parental Insurance Plan |

|

RL-7 |

Investments in an Investment Plan |

|

RL-8 |

Amount for Post-Secondary Studies |

|

RL-10 |

Tax Credit for a Labour-Sponsored Fund |

|

RL-16 |

Trust Income |

|

RL-19 |

Advance Payments of Tax Credits |

|

RL-22 |

Employment Income Related to Multi-Employer Insurance Plans |

|

RL-24 |

Childcare Expenses |

|

RL-25 |

Income from a Profit-Sharing Plan |

|

RL-26 |

Capital régional et coopératif Desjardins |

|

RL-29 |

Remuneration of a Family-Type Resource or an Intermediate Resource |