Set up electronic services

Security- Manage User Security

Before downloading tax data for Québec, the electronic services must be fully set up.

This step is mandatory to retrieve the necessary tax information from government agencies. Unless the setup is complete, it will not be possible to auto-fill or download tax data.

Note: No setup is necessary for Canada. When you auto-fill your return, you will be redirected to the CRA website, at which point you will need to enter your username and password.

Set up electronic services for Québec

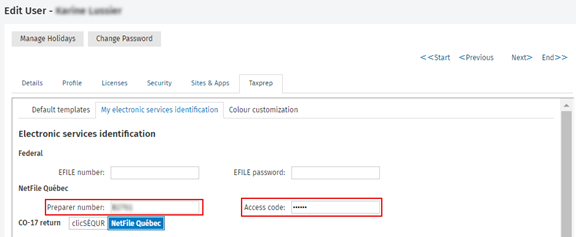

To set up electronic services for Québec and use the Revenu Québec Tax Data Download service, proceed as follows:

-

Click Settings, then Users. The User Manager page will display.

-

Click the relevant user account.

-

Click the Taxprep tab.

-

Click the My electronic services identification tab.

Note: You can also access this tab by clicking Settings > Taxprep > Electronic Services Identification.

-

Enter the required information in the Preparer number and Access code fields in the NetFile Québec subsection of the Electronic services identification section.

-

Click Save.