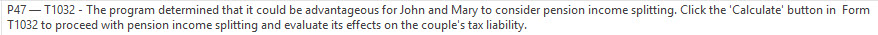

Taxprep generates a diagnostic when it detects that the taxpayer and the spouse could benefit from pension income splitting.

The presence of the diagnostic does not guarantee that pension income splitting is appropriate for the taxpayer and the spouse. Instead, it indicates that the preparer should analyze the couple’s family and financial situation and consider proceeding with income splitting.

To proceed with income splitting, you need to click the Calculate button of Form T1032, Joint Election to Split Pension Income (Jump Code: 1032).

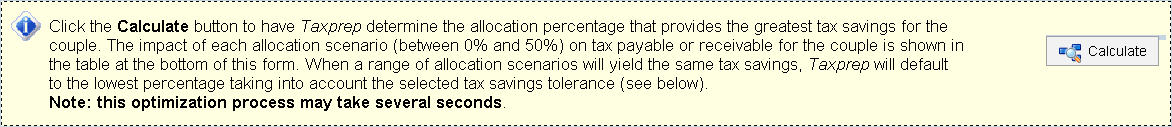

Taxprep determines the maximum percentage based on data in the taxpayer’s and the spouse’s returns (between 0% and 50%).

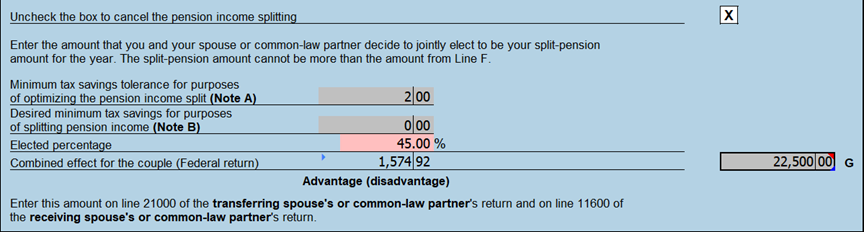

The percentage determined by Taxprep is automatically indicated by override under the Calculate button and the check box is selected.

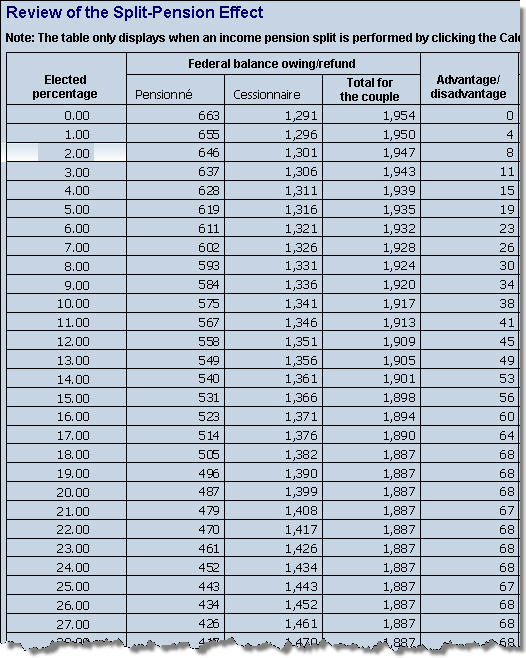

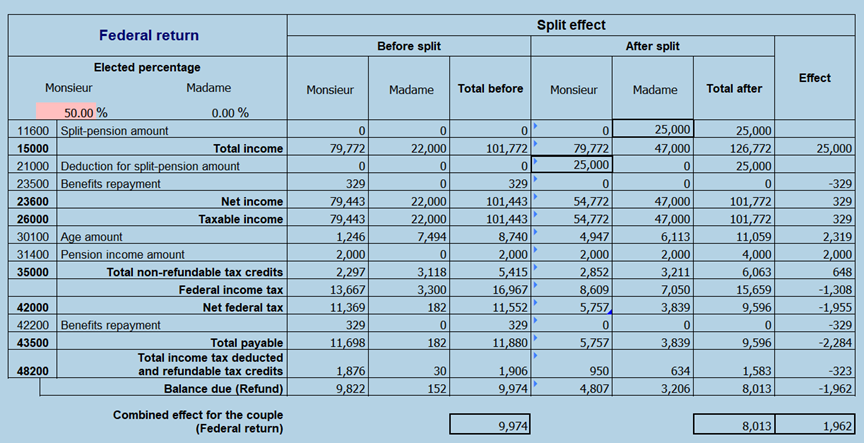

The comparison table Comparative Review of the Split-Pension Effect (Jump Code: 1032 COMP) is also updated in order to see the split effect on the returns of the transferring spouse or common-law partner and the receiving spouse or common-law partner and view the advantage for the couple. The tax savings for the couple that is calculated in this comparative summary is also reported in Form T1032, below the percentage determined. To find out what the functionalities of this comparative summary are, read the Section “To evaluate the different split scenarios” below.

Form T1032 is automatically completed. The last step is to have the taxpayer (transferring spouse or common-law partner) and the spouse (receiving spouse or common-law partner) sign the form.

Note: If the taxpayer and the spouse can split their pension income, it may be necessary to optimize using the Calculate button in the taxpayer’s Form T1032 and, thereafter, in the spouse’s form, to determine the best result.

Warning

When the taxpayer’s or the spouse’s return has been modified, the following diagnostic is generated:

![]()

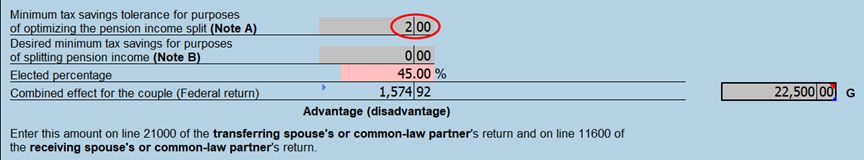

In order to allow you to customize the optimization relating to the election to split pension income from one spouse to another, Taxprep offers an option to define a tax savings tolerance which the taxpayer may waive in order for the split pension income amount to be as low as possible. By default, this tax savings tolerance was set at $2.00. This means that when optimizing the pension income split, the $2.00 tax savings will be taken into account in the elected percentage in order for the split pension income to be as low as possible. This tax savings tolerance can be modified in the preparer profile, in which case it will apply to all your client files or in Form T1032, Joint Election to Split Pension, if you want to apply it to the current file only.

T1032

|

Example: Here are the details of the balance due (refund) for a couple eligible for the pension income splitting according to the percentage of pension income transferred from one spouse to the other . Without the $2 tax savings tolerance option, the Taxprep pension income splitting optimization would have determined that the split rate providing the best tax savings was 12%. When the $2 tax savings tolerance is applied to the optimization, Taxprep determines that the optimal percentage is 4%. The income tax balance owed by the couple when a split rate of 4% is used only exceeds that of the balance owed when using a 12% split rate by $0.01. Because this $0.01 difference is within the $2 tax savings tolerance, this option allows you to transfer an amount of $2,576.80 instead of $7,730.40 (the amount that would have been determined by the optimization if the tax savings tolerance had not been applied). |

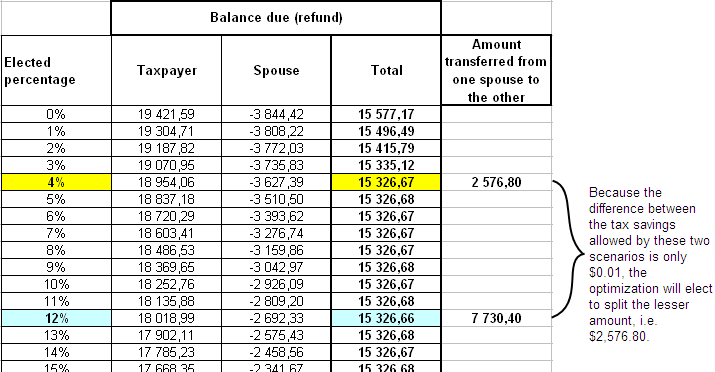

In order to allow you to customize the optimization relating to the election to split pension income, Taxprep offers an option that allows you to define the minimum tax savings that should be reached in order for the pension income split to be performed. If the tax savings resulting from a pension income split is lower than this amount, no split will be performed. If the defined minimum tax savings is reached, the split will be optimized taking into account the minimum tax savings tolerance (described in the previous paragraph).

The desired minimum tax savings can be modified in the preparer profile, in which case it will apply to all your client files or in Form T1032, if you want to apply it to the current file only. By default, the amount defined in the preparer profile is $0.

|

Example: Here is the tax savings of a couple eligible for the pension income split for whom no minimum tax savings was defined:

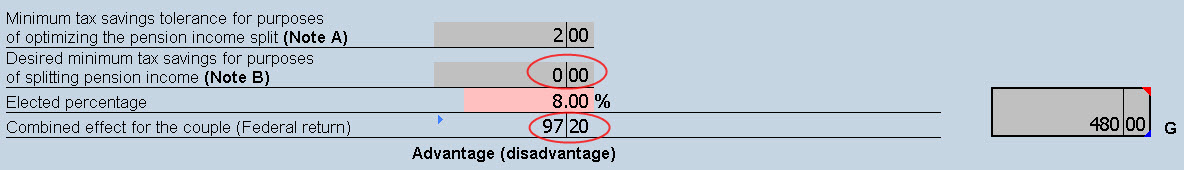

If a desired minimum tax savings of $100 is entered in the preparer profile and then the pension income split is performed again using the Calculate button, no split will be performed because the possible tax savings in this case is lower than the desired minimum tax savings.

|

When you perform a pension income split using the Calculate button, a table showing the effect of each split scenario on the transferring spouse or common-law partner tax return and that of the receiving spouse or common-law partner displays at the bottom of Form T1032. You can consult this table to see the scenario offering the best tax savings for the couple.

Taxprep validates the following basic criteria and generates diagnostics if income splitting is claimed for a non-eligible taxpayer:

- The taxpayer and the spouse separated in the year.

- The taxpayer and the spouse are not residents of Canada on December 31.

Taxprep automatically determines the eligible pension income amount on line A of Form T1032. If the transferring spouse or common-law partner is 65 years of age or older and received certain qualifying amounts distributed from a retirement compensation arrangement (box 17 of a T4A-RCA slip), Taxprep will add it as an eligible pension income on line 1 of Form T1032.

- The calculation is made based on data entered on the information slips (T4A, T4RSP, T4RIF, T4A-RCA) and workcharts.

- The calculation takes the age of the taxpayer into account since certain pension incomes are only eligible if the taxpayer is 65 or older.

Note: Payments for Old age security, Canada Pension Plan and the Québec pension plan are not eligible.

At the federal level, when the taxpayer’s marital status changed in the year (because of a union or a death), Taxprep automatically determines the pension amount eligible for income splitting. This pro rata is only applicable at the federal level, because in Québec, we should instead refer to the definition of spouse on December 31. See the details in the “Québec residents - Schedule Q.”

The date of marital status change entered in the Identification form is used to calculate the number of months during which the couple was married or had a common-law relationship.

Should the receiving spouse or common-law partner die, the date of death is used to calculate the number of months in the taxation year prior to the death.

Should the transferring spouse or common-law partner die, the number of months in the taxation year will modified to reflect the date of death (the fraction denominator in Step 2) as well as the number of months during which the couple was together (the numerator). As a result, if there were no new union in the year of death of the transferring spouse or common-law partner, the numerator equals 0 and there will be no reduction in the amount of pension eligible to transfer. If there was a new union, the numerator will reflect the number of months between the union date and the date of death of the transferring spouse or common-law partner.

If the receiving spouse or common-law partner dies in the year, the numerator will indicate the date of death of the receiving spouse or common-law partner, because it will be the date where the transferring spouse or common-law partner became widowed.

If the transferring spouse or common-law partner and the receiving spouse or common-law partner die in the same year and the receiving spouse or common-law partner dies before the transferring spouse or common-law partner, the numerator will indicate the number of months during which they were spouses until the date of death of the receiving spouse or common-law partner, because it represents the date where the transferring spouse or common-law partner became widowed.

Here are some examples:

Scenario # 1

Peter received a $62,500 pension and his wife, Mary, died on August 1 of the current year.

Peter’s pension income will be multiplied by 8 (number of months during which Mary was alive), and divided by 12 (number of months in Peter’s fiscal year).

In this case, Peter can only split a maximum of $20,833.34 in Mary’s final return.

Scenario # 2

Using the same situation as in Scenario #1, Peter dies on November 2, in the same year as Mary.

Peter’s pension income will be multiplied by 8 (number of months during which Mary was alive), and divided by 11 (number of months in Peter’s fiscal year).

In this case, Peter can only split a maximum of $22,727.28 in Mary’s final return.

Scenario # 3

Peter and Mary married on June 1 of the current year and Peter died on August 1 of that same year. Peter received a pension income amount of $62,500.

Peter’s pension income will be divided by 3 (number of months between the beginning of Peter’s union and death) divided by 8 (number of months in Peter’s fiscal year).

In this case, Peter can only split a maximum of $11,718.75 in Mary’s final return.

The transferred amount reduces the pension income eligible for the transferring spouse or common-law partner Pension income amount.

- Taxprep automatically determines the Pension income amount taking the split amount into account.

The pension income eligible for the transferring spouse or common-law partner Pension income amount is not necessarily pension income eligible for the spouse’s Pension income amount.

- Taxprep automatically determines if the pension income amount transferred to the spouse is a pension income amount eligible for the purpose of the spousal Pension income amount.

- The calculation is performed for each of the taxpayer’s source of pension income, based on the age of the spouse.

Note 1: The amounts distributed from a retirement compensation arrangement displayed in box 17 of your T4A-RCA slip are not eligible for the pension income amount.

Note 2: If the transferring spouse or common-law partner is in receipt of pension benefits that are reported in box 016 of the T4A slip, but are not considered eligible pension income for purposes of the pension income amount (e.g. benefits received from a unfunded Special Early Retirement Plan – SERP or benefits from an additional pension plan), you must enter this benefit amount in the T4A slip, in the field Amount in box 016 not eligible for the pension income tax credit. The total benefit amount will be excluded from the calculation of the eligible pension income in Section “Line 31400 – Pension income amount” of Form Federal Worksheet (Jump Code: FED CREDITS) to avoid overstating the amount of pension income eligible for pension income splitting. These benefits may be identified as “unregistered” in the footnotes on the T4A slip received.

Income tax withheld at source of the eligible pension income will have to be allocated from the transferring spouse or common-law partner to the spouse in the same proportion as the allocated pension income.

Taxprep automatically identifies tax withheld on the pension income eligible for income splitting:

- The income tax withheld is computed for each information slip based on the nature of the income and the transferring spouse or common-law partner age.

- For a taxpayer residing in a province outside Québec, the total income tax withheld will also include Québec tax withheld at source.

- The total income tax withheld with respect to pension income is then determined based on the percentage on Form T1032.

Tax attributable to split-income reduces income tax withheld at source for the transferring spouse or common-law partner and increases income tax withheld at source for the spouse.

This calculation is made in the "Calculation of the tax deemed paid by spouse pertaining to the split-income amount transferred" section of the calculation workchart for line 43700, Total Tax Deducted (Jump Code: 43700)

Both the taxpayer and the spouse must sign Form T1032. The form must be enclosed with the taxpayer’s return. A duly signed copy of the form must be enclosed with the spouse’s return as well.

When returns are filed electronically (EFILE), the form signed by both the taxpayer and the spouse must be retained so that it may be produced upon request.

Taxprep prints Form T1032 in the transferring spouse or common-law partner return and in the receiving spouse or common-law partner return. Furthermore, a diagnostic and a note in the Client Letter remind you to make both spouses sign the form and give you the tax saving amount resulting from the split. This allows you to retain a copy signed by both parties in their respective file.

For the taxpayer (the transferring spouse or common-law partner)

- The pension income reported on lines 11500 and 12900 is not changed.

- The income splitting amount on line G of Form T1032 is carried over to line 21000 of the return, reducing the transferring spouse or common-law partner net income.

- The income tax amount with respect to the split amount reported on line P of Form T1032 reduces the income tax amount withheld at source reported on line 43700 of the return.

- The income splitting amount reported on line G of Form T1032 reduces the amount eligible for the Pension income amount (line 31400) calculation.

For the spouse (the receiving spouse or common-law partner)

- The amount on line G of the taxpayer’s Form T1032 is carried over to line 11600 of the return, increasing the receiving spouse or common-law partner total income.

- The income tax amount with respect to the split amount reported on line P of the taxpayer’s Form T1032 increases the income tax amount withheld at source reported on line 43700 of the receiving spouse or common-law partner return.

- The split amount increases the amount eligible for the transferee’s pension income amount calculation to the extent that the allocated income is income eligible for the transferee’s pension income amount.

Old Age Security pension repayment

As a result of the pension income split, the receiving spouse or common-law partner may have to repay all or part of his or her Old Age Security pension on line 23500 of his or her current year return. However it is important to know that in addition to this repayment, part of the transferee’s pension will be withheld on next year’s Old Age Security pension payments.

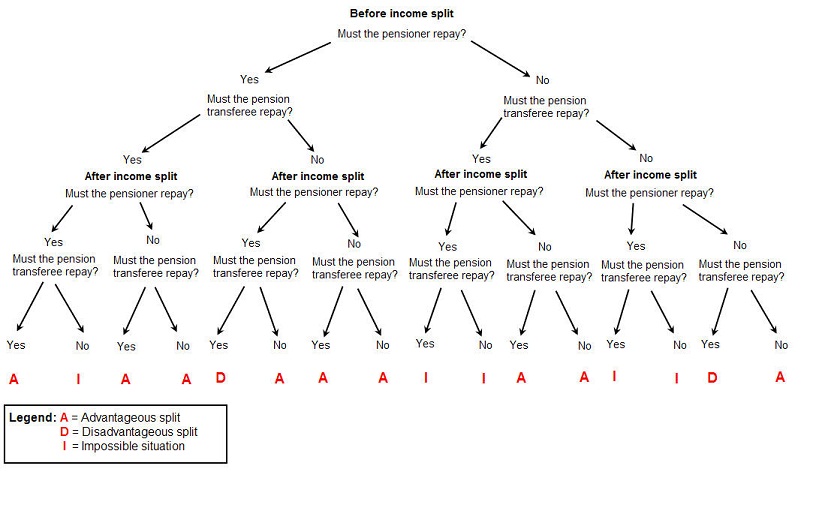

You can use the following diagram to determine whether or not it is advantageous to split pension income for a couple that might have to repay Old Age Security pension benefits.

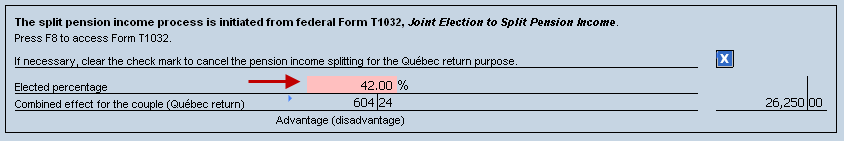

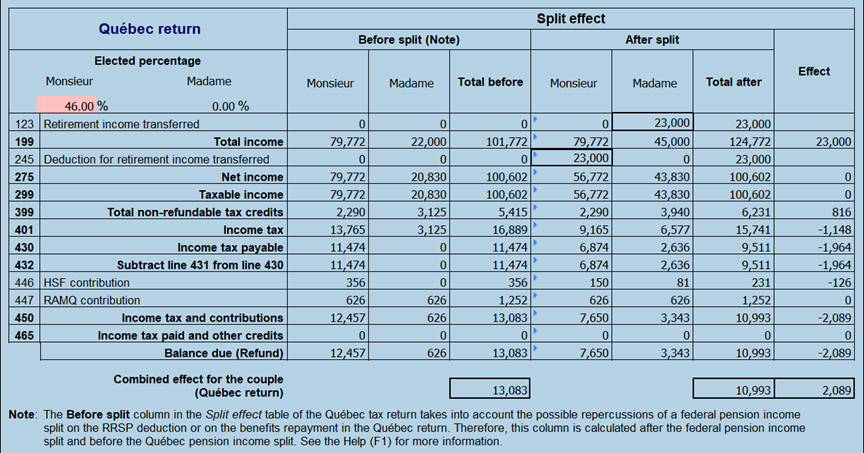

When clicking the Calculate button in Form T1032, the percentage applicable to the Québec return is also determined. The percentage applicable to the Québec return can be different from the percentage applicable to the federal return.

The percentage determined and the tax savings for the couple for Québec purposes is displayed in Schedule Q, Retirement Income Transferred to Your Spouse.

Since 2014, the transfer of retirement income between spouses is allowed only if the transferring spouse or common-law partner is 65 or older on December 31.

For the purpose of the Québec return, to be eligible for the pension income splitting, the spouses must meet the spouse on December 31 criteria.

Spouse on December 31

Person who was:

- your spouse at the end of that day. Note that you will be considered as having had a spouse on December 31 if you were separated on December 31 because of a breakdown in your marriage, but that breakdown lasted less than 90 days; or

- your spouse at the time of his or her death, if you were not living separately at that time because of a breakdown in your marriage and if you did not have a new spouse on December 31.

Therefore no proration will be applied to pension income eligible for the Québec split in the following situations (as opposed to what occurs at the federal level):

- New spouses (union in the year)

- Death of the receiving spouse or common-law partner in the year

If the split has been cancelled at the federal level (the check box of From T1032 has been cleared), the split will also be cancelled in Québec. To proceed with the split in Québec only, the check box in Schedule Q must be overridden.

If the transferring spouse or common-law partner resides in Canada but outside Québec, (and the taxpayer was 65 or older at the end of the year) the receiving spouse or common-law partner must include on line 123 of his or her Québec income tax return the amount that the transferring spouse or common-law partner deducted in his or her federal income tax return.

In this situation, Schedule Q should not be filed and will not be set as “Applicable”. Instead, you may wish to include a copy of the federal T1032 with the TP1 return.

If the receiving spouse or common-law partner resides in Canada but outside Quebec, the transferring spouse or common-law partner may deduct (on line 245 of his or her Québec income tax return) the amount he or she chose to deduct on his or her federal income tax return.

If you or your spouse on December 31 entered an amount on line 122 or line 123 of the return, you can enter a pension income amount.

Note: The Old Age Security pension (line 114), pensions paid under the Québec Pension Plan or the Canada Pension Plan (line 119) and life annuity payments made under a retirement compensation arrangement (line 123 or 154, as applicable) do not give rise to the amount for retirement income.

When a taxpayer (transferring spouse or common-law partner) elects to split retirement income with a spouse, the Québec income tax withheld at source on this income must be transferred in the same proportion as the split-income. The tax to be transferred is determined on Schedule Q.

The Québec instalments must be calculated as if the pension income transfer had not occurred.

Note that the taxpayer and spouse still have the option to calculate Québec tax using the estimated method if they wish to take into account the pension income transfer. However, in that case they may be subject to interest on any deficient instalments if in the following year their circumstances change.

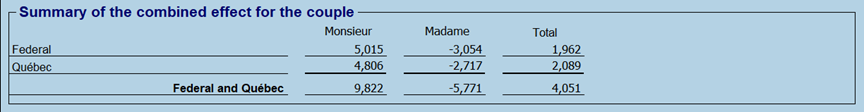

In addition to benefiting from progressive tax brackets, income splitting may provide the benefit of reducing the social benefits repayments and giving the spouse the benefit of the pension income amount. Income splitting also has less significant impacts on other tax credits, which will be beneficial or not, depending on whether the taxpayer is the transferring spouse or common-law partner or the receiving spouse or common-law partner. Income splitting requires a good comprehension of the taxpayer’s and the spouse’s overall financial situation. In some situations, the advice of a tax expert is strongly recommended.

To evaluate the split effect based on the different percentages, you must modify the determined % by override. The Comparative Review of the Split-Pension Effect workchart then gives the combined result for the couple based on the percentage entered.

If the variable printing option is selected in the Profile, only the lines of the Federal return and the Québec return that are impacted will be shown in the comparative review.

Québec residents

When a Québec return contains a deduction for an RRSP or a PRPP/VRSP (line 214) or a benefits repayment (line 250, code 03) and an income split in the federal return has an impact on these lines (lines 20800 and 23500 in the federal return), the combined effect of the income split in Québec for the couple is calculated as follows:

According to the Québec income tax guide, the RRSP deduction amount (line 214) and the benefits repayment amount (line 250, code 03) must correspond to the amount claimed in the federal return (lines 20800 and 23500, respectively). A federal income split having an impact on those lines will have a direct impact on the equivalent lines in the Québec return even if there is no Québec income split.

For these lines only, the Before split column in the “Québec return” section therefore presents the amount entered in the federal return, after a federal income split, in order for the comparison between the Before split and After split columns in the Québec return to exclude the impact of a federal income split on the Québec return.

In any event, if the result of the scenario is an inconvenience rather than an advantage for the couple, Taxprep generates the following diagnostic:

![]()

When it is not desirable to split, the check mark for box 9906 in Form T1032 must be cleared. This will cancel all calculations related to the split pension income.

![]()

We strongly recommend that the taxpayer’s and spouse’s returns are coupled to proceed with pension income splitting.

When this is not possible and you must file the receiving spouse or common-law partner return, the Form T1032T must be completed from the data in Form T1032 provided by the transferring spouse or common-law partner.

Transferring spouse or common-law partner must give a duly completed and signed copy of Form T1032 to their spouses to allow them to prepare their returns.

Here are some of the questions and answers with respect to the pension-income split:

For your information, we have copied below a CRA information document with respect to pension income splitting.

Q.1 What is pension income splitting?

A.1 Beginning with 2007 income tax returns, Canadian residents will generally be able to allocate up to one-half of their income that qualifies for the existing pension income tax credit to their resident spouse (or common-law partner) for income tax purposes.

The amount allocated is deducted in determining the net income of the person who actually received the pension income, and it is included in computing the net income of the spouse or common-law partner. Pension splitting affects the calculation of income and tax payable for both persons, so they must both agree to the allocation in their tax returns for the year in question.

Q.2 Is it necessary to contact the payer of the pension?

A.2 Splitting eligible pension income does not have any effect on how or to whom the pension income is paid, so it does not involve the payer of the pension. Information slips will be prepared and sent to the recipient of the pension income in the same manner as previous years.

Q.3 Who qualifies for pension income splitting?

A.3 A pension recipient (pensioner) and his or her spouse or common-law partner can elect to split the pensioner's “eligible pension income” received in the year if:

- they are married or in a common-law partnership with each other in the year and are not, because of a breakdown in their marriage or common-law partnership, living separate and apart from each other at the end of the year and for a period of 90 days commencing in the year[Footnote 1]; and

- they are both resident in Canada on December 31; or

- if deceased in the year, resident in Canada on the date of death; or

- if bankrupt in the year, resident in Canada on December 31 of the calendar year in which the tax year (pre- or post-bankruptcy) ends.

Q.4 What is “eligible pension income”?

A.4 Eligible pension income is generally the total of the following amounts received by the pensioner in the year:

- the taxable part of annuity payments from a superannuation or pension fund or plan; and

- if received as a result of the death of a spouse

or common-law partner, or if the pensioner is age 65 or older at the end

of the year:

- annuity and registered retirement income fund (including life income fund) payments;

- registered retirement savings plan annuity payments; and

- certain amounts received under a retirement compensation arrangement.

- if the pensioner is age 65 or older at end of the year:

- certain qualifying amounts distributed from a retirement compensation arrangement (box 17 of a T4A-RCA slip).

Note: Old Age Security and Canada or Quebec Pension Plan payments do not qualify.

Q.5 How do individuals elect to split eligible pension income?

A.5 The pensioner and spouse or common-law partner have to make a joint election in prescribed form with their income tax returns for the year on or before their filing due date (generally April 30 of the year following the tax year, or June 15 if self-employed). They must complete Form T1032, Joint Election to Split Pension Income. The income tax return includes a line (21000) for the pensioner to deduct the amount of pension allocated to the spouse or common-law partner. The new line 11600 allows the spouse or common-law partner to report the allocated pension income.

Q.6 Who will claim the tax withheld at source from the eligible pension income?

A.6 The income tax that is withheld at source from the eligible pension income will have to be allocated from the pensioner to the spouse or common-law partner in the same proportion as the pension income is allocated.

Q.7 Will pension income splitting affect the pension income amount?

A.7 The pensioner will be able to claim whichever amount is less: $2,000 or the amount of his or her eligible pension income after excluding amounts allocated to his or her spouse or common-law partner.

The spouse or common-law partner will be able to claim whichever amount is less: $2,000 or the amount of his or her pension income that is eligible for the pension income amount, including the allocated pension income.

Note: A pension that qualifies for the pension income amount in the hands of the pensioner does not necessarily qualify for the pension income amount in the spouse or common-law partner's hands because eligibility can depend on age (see question 4).

Q.8 Does pension splitting affect federal, provincial and territorial benefits, credits and programs?

A.8 Allocating pension income to a spouse or common-law partner reduces the pensioner's net income and increases the spouse or common-law partner's net income. As a result, benefits and tax credits that are calculated based on the total of the net incomes of both spouses or common-law partners—such as the GST/HST credit, CCB, and related provincial or territorial benefits—will not change as a result of pension splitting.

However, pension splitting will affect any tax credits and benefits that are calculated using one individual's net income, such as the age amount, the spouse or common-law partner amount, and the repayment of Old Age Security benefits.

Q.9 If pensioners intend to split pension income when filing their returns, can they ask for a reduction of tax being withheld from the eligible pension income during the year?

A.9 The CRA cannot approve a reduction of tax withheld at source based on an election to split pension income.

Q.10 If pensioners intend to make this election when filing their returns, can they reduce their instalment payments?

A.10 Many individuals, including pensioners, are required to pay tax by instalments, and the CRA issues instalment reminders to them indicating the amounts to be paid by each instalment due date. However, as an alternative to paying the amounts shown on the reminders, instalment payments can instead be made based on either the individual's prior-year net tax owing and CPP payable, or his or her estimated current-year net tax owing and CPP payable.

Under the current-year option, an individual can estimate his or her current-year net tax owing for the year based on the intention to split pension income. However, if the instalment payments are insufficient, instalment interest may be charged.

_____________________________

[Footnote 1]

A pensioner and his or her spouse or common-law partner will still be eligible to split pension income if living apart at the end of the year for medical, educational, or business reasons (rather than a breakdown in the marriage or common-law partnership).

See Also

Federal Income Tax and Benefit Guide – Lines 11500, 12900 and 43700