The following information is taken from pages 3 to 6 of the form.

Column A – Property class number

Depreciable property must be grouped in classes. Use a separate line for each class. If property in the same class was acquired for the purpose of earning income from more than one business, a separate class must be created for each such business.

A separate class must also be created for property in classes 43.1, 43.2, 50 and 53 acquired after December 3, 2018, and for property considered qualified intellectual property if the corporation can claim the additional capital cost allowance of 30% for it. For more information, see the instructions for line 250 in the Guide de la déclaration de revenus des sociétés (CO-17.G) (available in French only).

Column B – UCC at the beginning of the taxation year

For each class, enter the undepreciated capital cost (UCC) shown in the last column of the CCA table on the copy of form CO-130.A completed for the previous taxation year.

Column C – Capital cost of acquisitions made during the taxation year

For each class of property, enter the capital cost of depreciable property acquired during the taxation year and available for use. Also enter the cost of property acquired in previous taxation years that was available for use only during the current taxation year. (Such property was excluded in previous taxation years because it was not available for use.)

The capital cost of a property is generally the total cost incurred by the corporation to acquire the property and includes:

- legal, accounting, engineering or other fees incurred to acquire the property;

- site preparation, delivery, installation, testing or other costs incurred to put the property into use; and

- in the case of property the corporation manufactures for its own use, material, labour and overhead costs reasonably attributable to the property, but not any profit which might have been earned had the asset been sold.

In calculating the capital cost of property, you must deduct the amount of any assistance received, input tax credit (ITC) granted or input tax refund (ITR) claimed during the taxation year. Likewise, you must add the amount of any assistance, ITC or ITR already deducted that the corporation repaid (or is deemed to have repaid) during the taxation year.

Note that other rules reduce or increase the capital cost of certain property.

Column C.1 – Capital cost of AIIP acquired during the taxation year (included in the amount in column C)

If, for a given class of property, the amount in column C does not include any accelerated investment incentive property (AIIP), enter 0. Otherwise, for each class, enter the amount for the acquisition of AIIP included in column C. To be considered AIIP, the property must meet the following conditions:

- It was acquired after November 20, 2018.

- It became available for use during the taxation year and before 2028.

On form CO-130.A, property in new classes 54 and 55 is considered AIIP.

For more information, see section 8.3 in guide CO-17.G.

Column D – Adjustments

For each class, enter the total of the adjustments made in calculating UCC for the class.

To calculate the total:

- Add the aggregate of any assistance that meets the following conditions:

- It is related to depreciable property in the class.

- It was repaid by the corporation, under a legal obligation, after the corporation disposed of the property.

- It would have been included in the calculation of the property’s capital cost under section 101 of the Taxation Act had the repayment been made before the property’s disposition.

- Subtract the aggregate of any assistance that meets the following conditions:

- It is related to depreciable property in the class or was paid for the acquisition of such property.

- The corporation received or was entitled to receive it before claiming CAA and after disposing of the property.

- It would have been included, under section 101 of the Act, in the assistance the corporation received or was entitled to receive for the property had the assistance been received before the property’s disposition.

Important: Put a minus sign (–) before negative amounts in column D.

Column E – Proceeds of the disposition made during the taxation year

Determine the net proceeds of disposition for each property disposed of. The net proceeds correspond to either the capital cost of the property disposed of or the proceeds of disposition minus any expenses incurred for the disposition, whichever is less. Enter the total net proceeds of the disposition of property for each class.

Column F – UCC after acquisitions and dispositions

For each class, add the amounts in columns B, C and D, and then subtract the amount in column E.

If the result is negative, or if it is positive and there is no property left in the class at the end of the taxation year, enter 0 on the corresponding line in column K and follow the instructions in the section entitled “Recapture of CCA and terminal loss.”

Column F.1 – Proceeds of dispositions that may reduce the capital cost of AIIP acquired during the taxation year

If, for a given class of property, the amount in column C does not include any AIIP, enter 0. Otherwise, for each class, subtract the amount in column C.1 from the amount in column C, then subtract the result from the amount in column E. Finally, adjust the result as follows:

- Subtract the aggregate of any assistance that meets the following conditions:

- It is related to depreciable property in the class.

- It was repaid by the corporation, under a legal obligation, after the corporation disposed of the property.

- It would have been included in the calculation of the property’s capital cost under section 101 of the Taxation Act had the repayment been made before the property’s disposition.

- Add the aggregate of any assistance that meets the following conditions:

- It is related to depreciable property in the class or was paid for the acquisition of such property.

- The corporation received or was entitled to receive it before claiming CCA and after disposing of the property.

- It would have been included, under section 101 of the Act, in the assistance the corporation received or was entitled to receive for the property had the assistance been received before the property’s disposition.

Important: If the amount in column F.1 is negative, enter 0.

Column F.2 – Net capital cost for AIIP acquired during the taxation year

If, for a given class of property, the amount in column C does not include any AIIP, enter 0. Otherwise, for each class, subtract the amount in column F.1 from the amount in column C.1.

Column F.3 – UCC adjustment for AIIP acquired during the taxation year

If, for a given class of property, the amount in column C does not include any AIIP, enter 0. Otherwise, for each class, multiply the amount in column F.2 by the appropriate variable from the table below.

|

Class |

Variable applicable according to the date the property became available for use |

||

|

Before 2024 |

In 2024 or 2025 |

In 2026 or 2027 |

|

|

14.1 (property that is qualified intellectual property) |

19 |

9 |

0 |

|

43.1 or 54 |

7/3 |

1.5 |

5/6 |

|

43.2 |

1 |

0.5 |

0 |

|

44 (property that is qualified intellectual property) |

3 |

1 |

0 |

|

50 (property used mainly in Québec and acquired after December 3, 2018) |

9/11 |

0 |

0 |

|

53 |

1 |

0.5 |

0 |

|

55 |

1.5 |

7/8 |

3/8 |

|

14.1 or 44 (property that is not qualified intellectual property), 50 (property that is not used primarily in Québec or that was acquired between November 21 and December 3, 2018) or other class (except classes 12, 13, 14 and 15) |

0.5 |

0 |

0 |

|

12, 13, 14 and 15 |

0 |

0 |

0 |

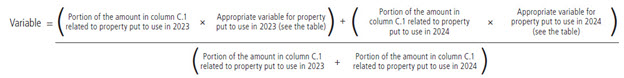

If the corporation’s taxation year begins in 2023 and ends in 2024, calculate the variable as follows:

If the corporation’s taxation year begins in 2025 and ends in 2026, calculate the variable the same way but replace 2023 by 2025 and 2024 by 2026.

For more information, see section 8.3 of guide CO-17.G.

Column G – UCC adjustment for non-AIIP acquired during the taxation year

The half-year rule does not apply to all property. For example, it does not apply to property in classes 13, 14, 15, 23, 24, 27, 29, 34 and 52, and to certain property in classes 10 and 12.

For AIIP, the half-year rule has been suspended until the end of 2027 (see section 8.3 of guide CO-17.G).

If the half-year rule does not apply to the class, enter 0 in column G. Otherwise, subtract the amounts in columns C.1 and E from the amount in column C, then multiply the result by 50%. Finally, adjust the result as follows:

- Subtract the aggregate of any assistance that meets the following conditions:

- It is related to depreciable property in the class.

- It was repaid by the corporation, under a legal obligation, after the corporation disposed of the property.

- It would have been included in the calculation of the property’s capital cost under section 101 of the Taxation Act had the repayment been made before the property’s disposition.

- Add the aggregate of any assistance that meets the following conditions:

- It is related to depreciable property in the class or was paid for the acquisition of such property.

- The corporation received or was entitled to receive it before claiming CCA and after disposing of the property.

- It would have been included, under section 101 of the Act, in the assistance the corporation received or was entitled to receive for the property had the assistance been received before the property’s disposition.

Column H – Base amount for calculating CCA

For each class, add the amounts in columns F and F.3. Then, subtract the amount in column G.

Column I – Rate

Enter the appropriate rate for each class. The rates are given in the table entitled “CCA rate by class of property.”

If the straight-line depreciation method is used for the property in the class, do not enter anything in column I.

Column J – CCA

For each class, multiply the amount in column H by the rate in column I. The result is the maximum amount that can be claimed as CCA.

Generally speaking, if a corporation’s taxation year is less than 12 months, the maximum amount allowable must be multiplied by the number of days in the taxation year, and the result divided by 365.

Note that there is an investment incentive for property in classes 13, 14 and 15 acquired after November 20, 2018, and put to use before 2028. Under the incentive, the maximum amount that a corporation can claim as CCA is increased. For more information, see section 8.3 of guide CO-17.G.

Enter the total of column J on line 107 of form CO-17.A.1, Revenu net fiscal (CO-17.A.1).

If an amount in column F is negative, it is a recapture of CCA. You must enter 0 on the corresponding line in column K; then add all the negative amounts in column F and enter the result on line 55 of form CO-17.A.1. This amount must be added to the corporation’s income.

If an amount in column F is positive and there is no more property of the same class at the end of the taxation year, it is a terminal loss. You must enter 0 on the corresponding line in column K; then add all the positive amounts in column F and enter the result on line 119 of form CO-17.A.1. This amount must be deducted from the corporation’s income.

There can be neither recapture of CCA nor a terminal loss for class 10.1 property.

Special cases

For specific details about certain classes of property, see Part 8 of guide CO-17.G (available in French only).

The following table shows the CCA rate for each class of property.

|

Class |

Rate |

Class |

Rate |

Class |

Rate |

|

1 |

4% |

17 |

8% |

41 |

25% |

|

2 |

6% |

18 |

60% |

42 |

12% |

|

3 |

5% |

22 |

50% |

43 |

30% |

|

4 |

6% |

23 |

100% |

43.1 |

30% |

|

5 |

10% |

25 |

100% |

43.2 |

50% |

|

6 |

10% |

26 |

5% |

44 |

25% |

|

7 |

15% |

28 |

30% |

46 |

30% |

|

8 |

20% |

29 |

50% |

50 |

55% |

|

8.1 |

33 1/3% |

30 |

40% |

53 |

50% |

|

9 |

25% |

31 |

5% |

54 |

30% |

|

10 |

30% |

32 |

10% |

55 |

40% |

|

10.1 |

30% |

33 |

15% |

||

|

11 |

35% |

35 |

7% |

||

|

12 |

100% |

37 |

15% |

||

|

14.1 |

5% |

38 |

30% |

||

|

16 |

40% |

39 |

25% |

The straight-line depreciation method is used with the following classes of property: 13, 14, 15 and 29. The CCA rate for class 36 property is 0%.

See Also

Schedule 8, Capital Cost Allowance (CCA)

IN-191, Capital Cost Allowance in Respect of Property Acquired After November 20, 2018