Schedule 8, Capital Cost Allowance (CCA)

Schedule 8 is a summary of all of the copies of the multiple copy form, Capital Cost Allowance (CCA)

Workchart (Jump Code: 8 WORKCHART).

These two forms are completely interrelated. You can access the information

in the workchart at any time by double-clicking a cell in Schedule 8.

Characteristics of the Capital Cost Allowance Workchart

The CCA workchart is completely dynamic, so the display in the workchart is modified according to the selected class.

Once the class is selected, only the relevant cells will appear for calculation purposes.

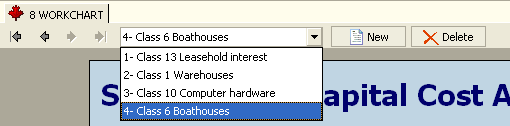

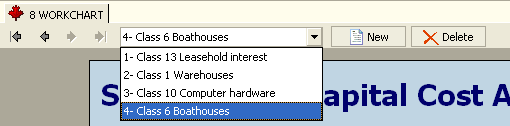

In the workchart, a drop-down menu (empty to start with) then displays the relevant information for each class created.

As a result, the following information is available for each class created:

- entry number (according to the order of creation);

- the number of the class on line 200;

Note: To

enable data import into a client file and to be able to ensure a better tracking of a CCA class that can have various CCA rates as a result of an additional CCA deduction, we have added a letter at the end of the number of the prescribed class to differentiate them. It consists of classes 1a at 10% (4% + 6%) and 1b at 6% (4% + 2%). Note that when paper printing all of the schedules that require a CCA class number, a custom class with a letter will be displayed, while when printing the schedules in “T2 - Bar codes” format and during electronic transmission of the federal return and the RSI schedules for Alberta requirements, the corresponding prescribed class number will continue being used.

- the description given to this class in the appropriate

cell;

- the “Québec” reference, in cases of a separate class that is used solely for the Québec income tax return and that relates to property qualifying for the additional CCA of 30%, the indicator “Québec.”

Below is an example of what the drop-down menu in the CCA workchart

could look like.

The classes are listed in the drop-down menu for line 200 and, according to the selected class, one of the following four data entry screens displays to calculate the CCA:

- CCA class 10.1;

- CCA class 13;

- CCA class 14;

- CCA other than classes 10.1, 13 and 14.

Numerous classes are available in the drop-down menu for line 200. All

of these classes are divided into five groups according to the display

that will automatically be available when a class is selected.

Thus, class 10.1 includes passenger vehicles; class 13 includes leaseholds,

class 14 includes patents, franchises, concession or licences, and classes

24, 27, 29 and 34 are for property that is generally used for manufacturing

and processing. All other classes are part of a general group that will

not change the original display of the workchart.

Linking a CCA Class to a Statement of Real Estate Rental Properties

(Regulation 1100(11))

Steps for linking a CCA class to a statement of real estate rental

property

A copy of the Statement of Real Estate

Rental Property must be completed for each rental property that

the corporation possesses either as a sole owner or as a co-owner.

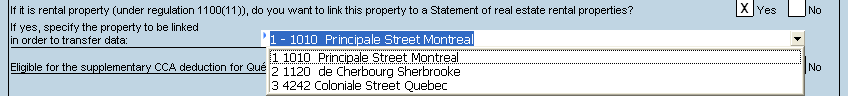

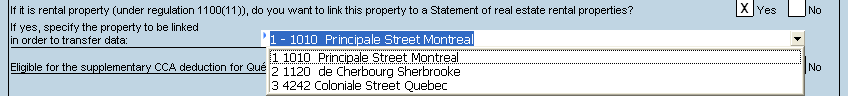

Then indicate that you want to link this property to a statement of

real estate rental property by answering the relevant question, and then,

using the drop-down menu, select the address of the property for which

you wish to transfer the information:

Consequently, all information relating to the calculation of the class

will be transferred to the “Calculation of capital cost allowance (CCA)”

section of the selected rental form and the program will be able to recalculate

the CCA based on the limitations for rental properties under regulation

1100(11).

This new CCA claim will updated to Schedule 8, Capital

Cost Allowance (CCA) (Jump Code: 8)

as well as to the T2 - Bar Code return.

The calculated federal CCA claim is automatically

updated to the Québec and Alberta CCA columns in the CCA workchart. Override

the provincial information if it differs from the federal.

CO-771, Calculation of the Income

Tax of a Corporation (Jump Code: 771)

When, in the Capital

Cost Allowance (CCA) Workchart (Jump Code: 8

WORKCHART), the CCA amount claimed with regard to rental properties

for Québec purposes differs from the amount claimed for federal purposes,

a diagnostic prompt you to review the income (or loss) amount from properties

calculated for Québec purposes on line 22, if applicable.

Data rolled forward

The real estate rental property will remain linked to a statement of

real estate rental property until you answer “Yes” to the question Was this the final year of your rental operation?

in the Statement of Real Estate Rental

Properties (Jump Code: RENTAL).

Sorting of CCA classes

Two sort functions are available in this schedule. When you click the first  button, the CCA classes will appear in an ascending order on their class number, both on screen and when printing. If the same class number is found twice or more, a second sort will automatically be performed: items from a same category will be classified in alphabetical order according to information in the Description column. When adding classes, you will have to repeat the process to sort them. In addition, when you click the second

button, the CCA classes will appear in an ascending order on their class number, both on screen and when printing. If the same class number is found twice or more, a second sort will automatically be performed: items from a same category will be classified in alphabetical order according to information in the Description column. When adding classes, you will have to repeat the process to sort them. In addition, when you click the second  button, the CCA classes will appear in an ascending order on their capital cost allowance (CCA) rate, both on screen and when printing. If the same CCA rate is found twice or more, a second sort will automatically be performed: items from a same CCA rate will be classified in an ascending on their Class number column. If the same class number is found twice or more, a third sort will automatically be performed: items from a same category will be classified in alphabetical order according to information in the Description column. When adding classes, you will have to repeat the process to sort them.

button, the CCA classes will appear in an ascending order on their capital cost allowance (CCA) rate, both on screen and when printing. If the same CCA rate is found twice or more, a second sort will automatically be performed: items from a same CCA rate will be classified in an ascending on their Class number column. If the same class number is found twice or more, a third sort will automatically be performed: items from a same category will be classified in alphabetical order according to information in the Description column. When adding classes, you will have to repeat the process to sort them.

Note that the  buttons will also be on the Forms CO-130.A, Capital Cost Allowance (Jump Code: Q8) and the Alberta Schedule 13, Capital Cost Allowance (Jump Code: A13). Any sort requested from one of these three forms will automatically be applied to the two other forms.

buttons will also be on the Forms CO-130.A, Capital Cost Allowance (Jump Code: Q8) and the Alberta Schedule 13, Capital Cost Allowance (Jump Code: A13). Any sort requested from one of these three forms will automatically be applied to the two other forms.

Capital Cost Allowance Claim Defaulted to Zero for all Classes

A check box allows you to cancel the default CCA calculation for all classes. Note

that terminal losses, recapture of capital cost allowance and any overrides

made on the CCA claimed will not be modified when the box is selected.

This check box will also be on Form CO-130.A, Capital

Cost Allowance (Jump Code: Q8)

and the Alberta Schedule 13, Alberta

Capital Cost Allowance (CCA) (Jump Code:

A13). The box appearing on the provincial forms will be selected

according to federal Schedule 8, but it will be possible to make a separate

election by overriding it.

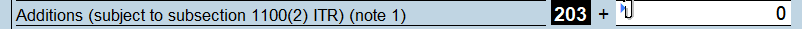

Additions in the year (line 203)

The available-for-use rule determines the earliest tax year in which

a corporation can claim CCA for depreciable property.

The property must be listed as an acquisition in the year (line 203)

in a given class for CCA purposes only

in the tax year where it is available for use based on the

available-for-use rule.

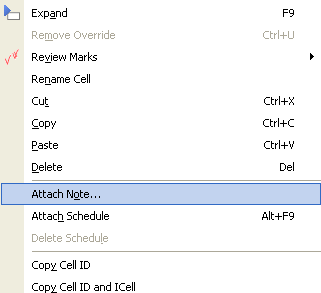

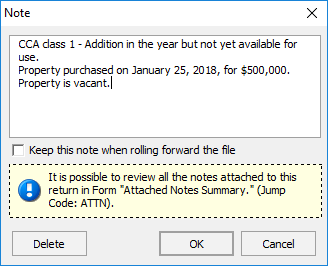

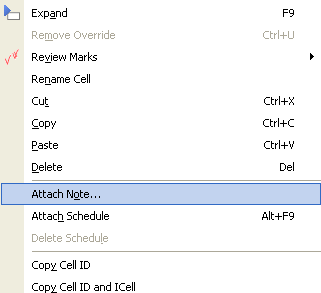

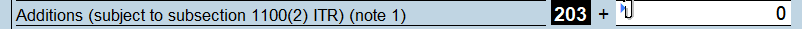

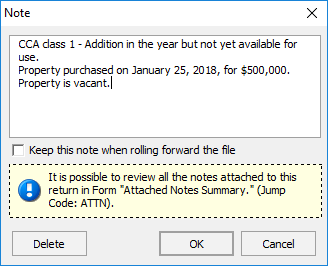

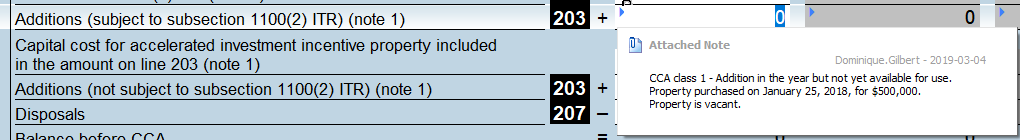

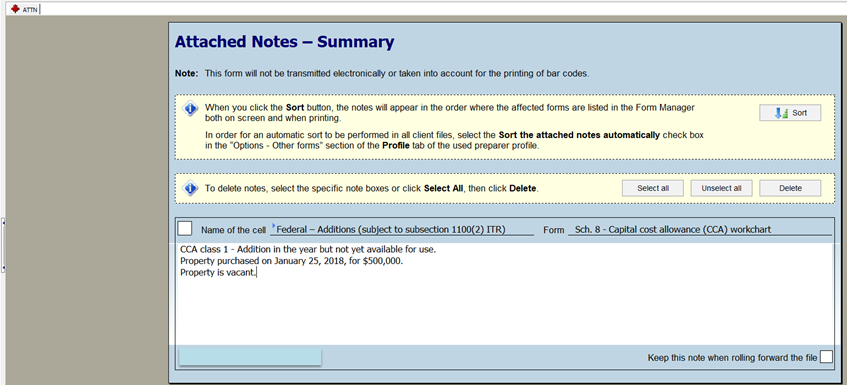

To remember to list a property that is not yet available for use, we suggest that you attach a note to the relevant line 203 on which you should enter as much information as possible.

You can keep this note when rolling forward the client file by selecting

both the box Keep this note when rolling

forward the file, in the Note

dialog box, and the box Keep the notes

attached to cells, under Options

and Settings/Roll Forward/Data Options.

Example:

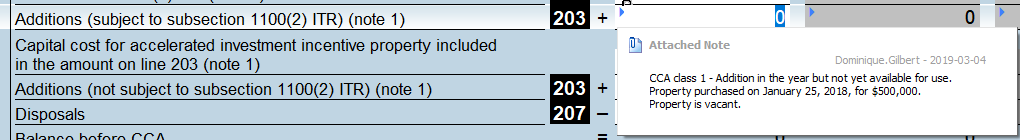

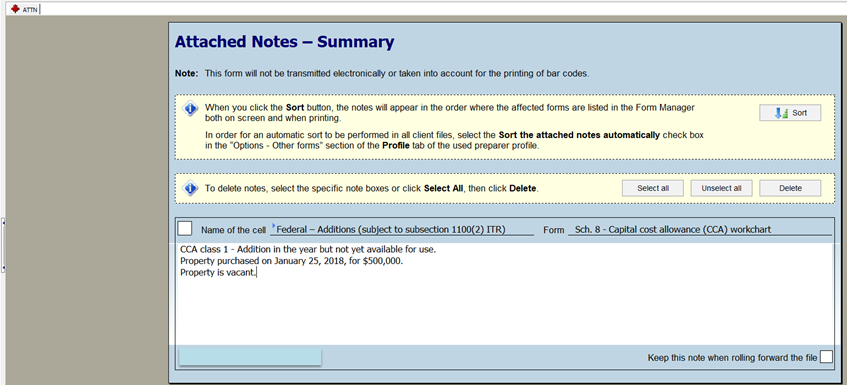

The content of the note can be consulted

at any time by placing your cursor on line 203 of the appropriate class

or by accessing the Attached Notes –

Summary (Jump Code: ATTN).

For more details on how to use attached

notes, consult the “Attached

Notes and Schedules”

Help topic.

Adjustments and transfers (lines 205)

In Schedule 8 WORKCHART, several separate lines have been created to help identify the adjustment type that is affecting the CCA class. The amounts entered on all these lines (including lines 221 and 222) aggregate the amount shown on line 205, Adjustments and transfers, in column 5 of Schedule 8.

ITC (prior year)

This line can be used to enter the federal investment tax credits (ITCs) (other than research and development ITCs) used to reduce tax payable or claimed as a refund in the previous tax year. It can also be used to enter any provincial or territorial ITCs received or entitled to be received by the corporation in the current year.

GST/PST rebate

This line can be used to enter the goods and services tax/harmonized sales tax (GST/HST) credit relating to property in a class, and any provincial sales tax (PST) credit, where applicable, claimed or entitled to be claimed, or the rebate received or entitled to be received by the corporation in the year.

Adjustments and transfers not affecting the adjustments under subsection 1100(2) ITR

The amount on the line can be used to deduct, among other things, the amount of the capital cost reduction of the class resulting from the application of section 80 ITA as well as the government assistance received or entitled to be received in the year with respect to property in the class.

The amount on the line can also be used to add, among other things, the value of depreciable property transferred as a result of the amalgamation or winding-up of a subsidiary or in accordance with section 85 ITA, rebates of sales tax (provincial or federal) or GST/HST input tax credits with respect to property in the class as well as the government assistance amount repaid in the year that previously reduced the capital cost of the class;

Assistance received during the year or amount repaid during the year for a property after its disposition

The amounts entered on these lines are included in the calculation of the lines relating to the UCC adjustment under subsection 1100(2) of the Income Tax Regulations.

Eligible capital property (Class 14.1)

Eligible capital property (Class 14.1)

Creation of class 14.1

When the corporation's taxation year starts on January 1, 2017, class 14.1 will automatically be created when the client file is rolled forward from the information contained in Schedule 10, Cumulative Eligible Capital Deduction and Schedule 10 WORKCHART, Cumulative Eligible Capital Deduction Workchart.

A separate class 14.1 will be created for each different business name entered in Schedule 10 WORKCHART. All copies of Schedule 10 WORKCHART not containing a business name will be grouped in a single copy for class 14.1.

Data rolled forward from Schedule 10 when the taxation year starts on January 1, 2017

Cumulative eligible capital (CEC) balance (positive or negative) in respect of the business on January 1, 2017 (Line G)

To calculate the deemed capital cost of property for this class, indicate the cumulative eligible capital (CEC) amount on January 1, 2017. When a client file is rolled forward, the program inputs the total of amounts M from the copies of Schedule 10 WORKCHART in which the business name is identical.

Deductions that reduced the CEC in respect of the business for taxation years ending before January 1, 2017 (Line I)

This amount is used to calculate the deemed capital cost of the property in the class. When a client file is rolled forward, this amount corresponds to the sum of the total amount in the CEC deduction from income (line 250) column of the Table of CEC deduction from income of previous years, located under Part 2 in Schedule 10, and the amount of the current year deduction entered on line 250 of Schedule 10.

Data calculated to manage the information relating to property acquired before January 1, 2017

Deemed total capital cost of property in the class under paragraph 13(38)(a) ITA (Line K)

This amount will be calculated based on the following formula:

(4/3 x [G + (3/2 x H) + I + J])

where

G is the CEC balance (positive or negative) in respect of the business on January 1, 2017

H is the amount that would need to be included in income pursuant to paragraph 14(1)(b) ITA, as that paragraph applied immediately before January 1, 2017, when the CEC balance is negative.

I is the total of the deductions that reduced the CEC in respect of the business for taxation years ending before January 1, 2017.

J is item D.1 of the CEC definition set out in paragraph 14(5) ITA, as that paragraph applied immediately before January 1, 2017, when the CEC balance is negative.

Amount deemed allowed as a deduction against the capital cost of property in the class under paragraph 13(38)(c) ITA for taxation years ending before January 1, 2017 (Line L)

The deemed CCA allowed is equal to the difference between the deemed total capital cost and the positive CEC balance at the time of the roll forward.

UCC balance in the class on January 1, 2017 (Line M)

The UCC balance is equal to the difference between the deemed total capital cost and the deemed CCA allowed. Any positive result obtained also corresponds to the UCC balance (opening) entered on line 201, if this amount is positive. In general, the UCC balance at the time the class is created will be equal to the CEC balance in respect of the business (line G).

CCA claimed with respect to this UCC balance in preceding taxation years (Line N)

This is the total amount of the capital cost allowance (CCA) and the additional deduction that has been deducted from the UCC balance in the class on January 1, 2017 (line M), for taxation years ending between January 1, 2017, and December 31, 2026. This amount will be calculated each year when the client file is rolled forward.

The amount updated to this line will vary according to the CCA claimed. When rolling forward a client file, the program will automatically add to the amount entered on the line in the initial client file, the lesser of:

- the total of the CCA and the additional deduction calculated for the UCC balance on January 1, 2017, net of the CCA amount claimed with respect to this UCC balance in prior years; and

- the CCA amount claimed on line 217 for the class.

When the CCA amount claimed on line 217 of the form is not nil and it is different from the maximum CCA that can be claimed by the corporation, verify if the amount updated is correct.

Additional deduction

For taxation years ending before 2027, an additional deduction corresponding to 2% of the UCC in the class on January 1, 2017, can be claimed with respect to property of a business that has been acquired before January 1, 2017. This additional deduction is however reduced from any amount that has been deducted in prior taxation years and three times the total of the amounts deducted from the UCC because of the amounts received to which subsection 13(39) ITA applies.

Furthermore, if the total of that additional deduction and the eligible CCA for the year is less than $500, the additional deduction may be increased to allow a total CCA of $500, without exceeding the UCC in the class on January 1, 2017 (net of CCA deductions for prior years that started after January 1, 2017), or to ensure that the CCA in respect of the class for the year to be more than the UCC balance (before the application of such deduction).

Transitional rules – Subsections 13(38) to 13(42) ITA

Subsections 13(38) to (42) ITA provide for the transitional rules that apply as a result of the repealing of the eligible capital property rules and the addition of CCA class 14.1.

Subsection 13(38) ITA provides for the rules that apply where an eligible capital expenditure in respect of a business has been incurred before January 1, 2017.

Subsection 13(39) ITA sets forth the rules that apply where certain property that was eligible capital property before January 1, 2017, is disposed of on or after January 1, 2017.

Subsection 13(40) ITA prevents the use of subsection 13(39) ITA to “step-up” the UCC in the new class by means of a non-arm’s length transfer of property that was eligible capital property before January 1, 2017.

Subsection 13(41) ITA sets forth that the terms “cumulative eligible capital,” “eligible capital expenditure,” “eligible capital property” and “exempt gains balance” have the same meaning as the version of the Act in effect immediately before 2017, for the application of subsections 13(38) to (40) and (42), paragraph 20(1)(hh.1), subsections 40(13) to (16) and paragraph 79(4)(b) ITA.

Subsection 13(42) ITA provides special rules put in place as a result of the repeal of the eligible capital property rules. These rules apply if a taxpayer owns property included in class 14.1 in respect of a business at the beginning of January 1, 2017.

Classes 43.1 and 43.2 only

Classes 43.1 and 43.2 only

Based on CRA requirements, when property acquired during the year is included in CCA class 43.1 or 43.2 on line 203, additional information is required with respect to each of these acquisitions. This information is used for statistical purposes only.

Therefore, a section has been added to the Capital Cost Allowance (CCA) Workchart (Jump Code: 8 WORKCHART), for these two CCA classes only. This section displays when an acquisition amount is entered on line 203 for property in class 43.1 or 43.2. It includes multi-lines areas that allow you to provide the information required for each of the property acquisitions included in one of these classes. Follow the instructions below to complete the section:

- Column 301, Type of asset code: Choose the most appropriate code from a list of 20 codes provided by the CRA. See the complete list of these codes and related definitions below.

- Column 302, Province where the asset is located: By default, the program determines the province where the corporation’s head office (corporation’s head office – provincial or territorial jurisdictions of Canada only) is located based on information indicated on line 016 of Form Identification (Jump Code: ID). Validate the province determined by the program and change it if applicable.

- Column 303, Percentage allocated to the asset: Indicate the percentage of each property acquisition with relation to the total amount of property acquisitions during the year (line 203) for the given class (43.1 or 43.2). The total of the percentages allocated to the property in a class must be equal to 100%.

Note that the CRA does not want to add these lines on its Schedule 8. This is why this information is not found on the paper copy of Schedule 8; it appears on screen only. However, this information is mandatory: it is included in the bar codes and is transmitted electronically.

Line 301 - Type of asset code and definition

|

Codes

|

Description

|

Definition

|

|

Code 01

|

Cogeneration systems

|

Cogeneration systems include certain equipment that is part of a system that is used to generate electricity and useful heat from eligible fuels or thermal waste. The eligible fuels include fossil fuels (i.e., petroleum, natural gas or related hydrocarbons, basic oxygen furnace gas, blast furnace gas, coal, coal gas, coke, coke oven gas, lignite, peat, or solution gas), and specified waste fuels (e.g., biogas, bio-oil, digester gas, landfill gas, municipal waste, plant residue, pulp and paper waste, wood waste or spent pulping liquor).

|

|

Code 02

|

Waste-fuelled electrical generation equipment

|

Waste fuelled electrical generation equipment includes certain equipment where the equipment is part of a system that is used to generate electricity only using specified waste fuels (e.g., biogas, bio-oil, digester gas, landfill gas, municipal waste, plant residue, pulp and paper waste, wood waste or spent pulping liquor).

|

|

Code 03

|

Thermal waste electrical generation equipment

|

Thermal waste electrical generation equipment includes equipment that is used to generate electrical energy in a process where all or substantially all of the energy input is thermal waste.

|

|

Code 04

|

Wind energy conversion systems

|

Wind energy conversion systems include fixed location equipment that is used primarily for the purpose of converting wind energy into electrical energy.

|

|

Code 05

|

Small-scale hydro-electric installations

|

Small-scale hydro-electric installations include hydro-electric generating installations with a rated capacity at the installation site of 50 megawatts (MW) or less.

|

|

Code 06

|

Fuel cell equipment

|

Fixed location fuel cell equipment includes property used to generate electrical energy or electrical energy and heat from hydrogen by the electrochemical reaction of hydrogen and oxygen. Eligible fuel cell equipment uses oxygen in the air and hydrogen generated from:

- fossil fuels (i.e., petroleum, natural gas or related hydrocarbons, basic oxygen furnace gas, blast furnace gas, coal, coal gas, coke, coke oven gas, lignite, peat, or solution gas) or eligible waste fuels (i.e., biogas, bio-oil, digester gas, landfill gas, municipal waste, plant residue, pulp and paper waste, wood waste) by internal or ancillary fuel reformation equipment that is part of an electrical energy generation or cogeneration system; or,

- water by ancillary electrolysis equipment (or the fuel cell itself if the fuel cell is reversible) that uses electrical energy, all or substantially all of which is generated from photovoltaic, wind energy conversion or hydro-electric equipment.

|

|

Code 07

|

Photovoltaic equipment

|

Photovoltaic electrical generation equipment includes fixed location photovoltaic equipment that is used primarily for the purpose of generating electrical energy from solar energy.

|

|

Code 08

|

Wave/tidal energy equipment

|

Wave or tidal energy equipment includes equipment that is used primarily for the purpose of generating electrical energy from wave or tidal energy (otherwise than by using physical barriers or dam-like structures). Budget 2014 proposes to expand eligibility to include water-current energy equipment. Eligible water-current energy property will include equipment used primarily for the purposes of generating electricity using the kinetic energy from flowing water (otherwise than by using physical barriers or flow diversion).

|

|

Code 09

|

Geothermal energy equipment

|

Geothermal electrical generation equipment includes equipment used primarily for the purpose of generating electrical energy solely from geothermal energy.

|

|

Code 10

|

Active solar heating equipment

|

Active solar heating equipment includes property that is used primarily for the purpose of heating an actively circulated liquid or gas. It refers to equipment that uses a liquid or gas to transfer heat - collected from solar energy in solar collectors - to water heaters or solar energy conversion equipment.

|

|

Code 11

|

Ground source heat pump systems

|

Ground-source heat pump systems includes property that is used primarily for the purpose of heating an actively circulated liquid or gas by using the ground as a solar energy collector and a heat pump to extract and convert thermal energy from the ground into useful heat.

|

|

Code 12

|

District energy equipment

|

District energy equipment includes equipment that is part of a district energy system that is used primarily to provide heating or cooling from a central thermal energy generation unit to one or more buildings. The thermal energy is primarily generated by: an eligible cogeneration system, active solar heating equipment, a ground-source heat pump system, a heat recovery equipment or waste fuelled thermal energy equipment.

|

|

Code 13

|

Waste-fuelled thermal energy equipment

|

Waste fuelled thermal energy equipment includes equipment used primarily for the purpose of generating heat energy from the consumption of eligible waste fuel (i.e., biogas, bio-oil, digester gas, landfill gas, municipal waste, plant residue, pulp and paper waste or wood waste).

|

|

Code 14

|

Heat recovery equipment

|

Heat recovery equipment includes equipment that is used primarily for the purpose of conserving energy or reducing the requirement to acquire energy and that recovers thermal waste generated by an eligible electrical generation or cogeneration system, or an industrial process.

|

|

Code 15

|

Landfill gas/digester gas collection equipment

|

Landfill gas and digester gas collection equipment includes equipment used primarily for the purpose of collecting landfill gas or digester gas.

|

|

Code 16

|

Bio-oil production systems

|

Bio-oil production systems include equipment that converts wood waste or plant residue into bio-oil by a thermo-chemical conversion process that takes place in the absence of oxygen.

|

|

Code 17

|

Biogas production systems

|

Biogas production systems produce biogas by anaerobic digestion of eligible organic waste. They include equipment that is part of a system that is primarily used to produce and store biogas.

|

|

Code 18

|

Enhanced combined cycle systems

|

Enhanced combined cycle systems include equipment of a combined cycle process where at least 20 percent of the heat input to the process is recovered from the thermal waste of a natural gas compressor system. The recovered heat input to the system must be used to enhance the generation of electrical energy.

|

|

Code 19

|

Expansion engine system

|

Expansion engine systems include certain expansion engines, with one or more turbines, or cylinders, that are used to convert the compression energy in pressurized natural gas into shaft power that generates electricity.

|

|

Code 20

|

Gasification equipment

|

Budget 2014 proposes to include property used to gasify eligible waste fuel (i.e., biogas, bio-oil, digester gas, landfill gas, municipal waste, plant residue, pulp and paper waste or wood waste) for other applications (e.g., to sell the producer gas for domestic or commercial use). Eligible gasification property will include equipment used primarily to produce producer gas.

|

|

Code 20

|

Gasification equipment

|

Budget 2014 proposes to include property used to gasify eligible waste fuel (i.e., biogas, bio-oil, digester gas, landfill gas, municipal waste, plant residue, pulp and paper waste or wood waste) for other applications (e.g., to sell the producer gas for domestic or commercial use). Eligible gasification property will include equipment used primarily to produce producer gas.

|

|

Code 21

|

Electric vehicle charging stations

|

For property acquired for use after March 21, 2016 that has not been used or acquired for use before March 22, 2016, the budget proposes that:

- EVCSs set up to supply more than 10 kilowatts but less than 90 kilowatts of continuous power will be eligible for inclusion in class 43.1; and

- EVCSs set up to supply at least 90 kilowatts of continuous power will be eligible for inclusion in class 43.2.

Eligible equipment of a taxpayer will include equipment downstream of an electricity meter, owned by an electric utility and used for billing purposes or owned by the taxpayer to measure electricity generated by the taxpayer, provided that more than 75% of the annual electricity consumed in connection with the equipment is used to charge electric vehicles, including: charging stations, transformers, distribution and control panels, circuit breakers, conduits, wiring and related electrical energy storage equipment.

|

|

Code 22

|

Electrical energy storage

|

For property acquired for use after March 21, 2016 that has not been used or acquired for use before March 22, 2016, the budget proposes that:

- if the storage equipment is part of an electricity generation system that is eligible for class 43.1 (i.e., a mid-efficiency cogeneration system), it will be included in class 43.1; and

- if the storage equipment is part of an electricity generation system that is eligible for class 43.2 (e.g., an eligible renewable, waste-fueled or high-efficiency cogeneration system), it will be included in class 43.2.

The budget also proposes to allow stand-alone electrical energy storage property to be included in class 43.1 provided that the round trip efficiency of the equipment is greater than 50%. The round trip efficiency measures the extent to which energy is maintained in the process of converting electricity into another form of energy and then back into electricity.

Eligible electrical energy storage property will include equipment such as batteries, flywheels, and compressed air energy storage. It will also include any ancillary equipment and structures. Eligible electrical energy storage property will not include: pumped hydroelectric storage, hydroelectric dams and reservoirs, or a fuel cell system where the hydrogen is produced via steam reformation of methane. Consistent with the policy intent of class 43.1 and 43.2, certain uses of electrical energy storage equipment will also be excluded from eligibility: back up electricity generation, motive uses (e.g., in battery electric vehicles or fuel cell electric vehicles) and mobile uses (e.g., consumer batteries).

|

Classes 54, 55 and 56 (zero-emission equipment and vehicles)

Classes 54, 55 and 56 (zero-emission equipment and vehicles)

There are three CCA classes for zero-emission equipment that become available for use before 2028:

- class 54 (CCA rate of 30%) for zero-emission motor vehicles and passenger vehicles, that would be included in class 10 or class 10.1;

- class 55 (CCA rate of 40%) for zero-emission vehicles, that would be included in class 16; and

- class 56 (CCA rate of 30%) for zero-emission equipment and vehicles, that are not included in CCA classes 54 and 55.

These three CCA classes benefit from a temporary enhanced first-year CCA rate of 100% applicable to eligible zero-emission automotive equipment and vehicles that are acquired after March 18, 2019, (after March 1, 2020, for CCA class 56) and that become available for use before 2024. The enhanced rate is reduced to 75% after 2023 and before 2026 and to 55% after 2025 and before 2028.

A “zero-emission vehicle” is:

- a motor vehicle as defined in the Income Tax Act;

- a fully electric or a plug-in hybrid vehicle, with a battery capacity of at least 15 kWh or fully powered by hydrogen;

- a new vehicle, i.e. it must not have been used, or acquired for use, for any purpose before it is acquired by the taxpayer;

- a vehicle in respect of which no assistance has been paid by the Government of Canada under the federal purchase incentive announced on March 19, 2019.

A “zero-emission passenger vehicle” is an automobile (as defined in the ITA) that is included in class 54.

For each zero-emission passenger vehicle included in class 54 that is available for use in the taxation year, a limit of $55,000 (plus the sales taxes applicable on this amount) is applied to the capital cost eligible for CCA. In addition, where the vehicle is disposed of to a person or partnership with which the taxpayer deals at arm’s length,

- if the disposition occurs before July 30, 2019, the actual proceeds of disposition are multiplied by the ratio corresponding to the capital cost of the vehicle divided by the actual cost of the vehicle;

- in other cases, the actual proceeds of disposition are multiplied by the ratio corresponding to the capital cost of the vehicle divided by the result of the following formula:

D + (E + F) – (G + H)

where

D is the cost to the taxpayer of the vehicle,

E is the amount determined under paragraph 13(7.1)(d) ITA in respect of the vehicle at the time of disposition,

F is the maximum amount determined for C in the UCC definition set out in subsection 13(21) ITA in respect of the vehicle,

G is the amount determined under paragraph 13(7.1)(f) ITA in respect of the vehicle at the time of disposition, and

H is the maximum amount determined for J in the UCC definition set out in subsection 13(21) ITA in respect of the vehicle.

When the Additions and Dispositions Workchart is used, the program calculates the eligible capital cost of a zero-emission passenger vehicle in the year of acquisition as well as the proceeds of disposition in the year of disposition when you complete the “Information relating to zero-emission vehicles” section. The field “Government assistance received or repaid” located in the “Disposition of a zero-emission passenger vehicle” subsection should be used to enter the result obtained according to the portion (E + F) – (G + H) of the formula described above to allow for the calculation of the proceeds of disposition when the disposition is made after July 29, 2019.

Property included in classes 54, 55 and 56 are not AIIP and the half-year rule does not apply to them. However, note that, for the purposes of the calculations in Schedule 8, the CRA considers property in these classes acquired in the taxation year to be AIIP.

Subsection 1103(2j) ITR provides for an election to not include in class 54 or 55 a vehicle that would otherwise be a zero-emission vehicle. This election means that such a vehicle would not be a zero-emission vehicle but would be included in its usual CCA class (class 10, 10.1 or 16). For CCA class 56, such election could also be made to include property in the class for which it would otherwise be eligible.

Property qualified for accelerated depreciation

Property qualified for accelerated depreciation

Accelerated investment incentive property (AIIP)

To qualify, these properties must be acquired and available for use after November 20, 2018. In addition, certain properties are excluded from the definition, in particular:

- property acquired on a rollover basis (section 85 ITA), or following an amalgamation (section 87 ITA) or the wind-up of a subsidiary (section 88 ITA);

- property previously owned or acquired by the taxpayer or by a person or partnership with which the taxpayer did not deal at arm’s length at any time when the property was owned or acquired by the person or partnership.

AIIP acquired in the tax year will not be subject to the “half-year rule” but will benefit from an increased CCA adjustment in the year of acquisition. Subsection 1100(2) ITR now incorporates several rules to calculate the first-year allowance according to the CCA class:

- The general rule that applies for all CCA classes subject to subsection 1100(2) ITR (except classes 12, 13, 14, 15, 43.1, 43.2 and 53) allows for an increase in the UCC balance before CCA equal to 50% of the net additions (these is no addition for property acquired and available for use after 2023 and before 2028).

- Specific rules that apply to classes 43.1, 43.2 and 53, benefit from a 100% CCA of the cost of acquisition for property acquired and available for use after November 20, 2018, and before 2024. A phase-out of the increased CCA is defined for each CCA class for property available for use after 2023 and before 2028.

- The half-year rule, which always apply to property that do not meet the definition of “accelerated investment incentive property” from subsection 1104(4) ITR as well as property acquired and available for use before November 21, 2018, and after 2027.

In addition, specific rules are provided for CCA classes 13 and 14 in paragraphs 1100(1)(b) and (c) ITR. Therefore, for AIIP in CCA classes 13 and 14, the CCA will be equal to 150% of the CCA that would normally be calculated in the year of acquisition of the property.

Calculation of line Maximum allowable CCA in the Federal column

For CCA classes other than 10.1, 13 and 14 or other than classes 24, 27, 29 and 34, the custom line 225, Cost of additions of AIIP included in the amount on line 203, allows you to enter the capital cost of qualified property. This line is used to calculate the amount on the line UCC adjustment for AIIP acquired during the year, according to the CCA class selected, and as a result, take into account the rules in respect of subsection 1100(2) ITR when calculating the amount on the line Maximum allowable CCA. When the corporation’s taxation year starts after November 20, 2018, the amount on this line is calculated and equals the amount on line 203, Additions (property subject to subsection 1100(2) ITR). Note that the calculation of the line UCC balance for CCA calculation has not been modified for CCA classes 24, 27, 29 and 34 as it is no longer possible to acquire property in these classes.

For a CCA class 10.1, the custom question Is the property an accelerated investment incentive property, as defined under subsection 1104(4) ITR? allows you to indicate if the property qualifies for the increased CCA. If the answer the question is “Yes,” the amount entered on the line Maximum allowable CCA will take into account the general rule for qualified property. When the corporation’s taxation year ends after November 20, 2018, and the acquisition date is after November 20, 2018, and is part of the taxation year, the answer to the custom question is set to “Yes.”

For CCA class 13, line 225, Cost of additions of AIIP included in the amount on line 203, allows you to enter the capital cost of qualified property. This line is used to calculate the amount added to the line Maximum allowable CCA taking into account clause 1100(1)(b)(i)(A) ITR. When the corporation’s taxation year starts after November 20, 2018, the amount on this line is calculated and equals the amount on line 203, Current-year additions, property subject to subparagraph 1100(1)(b)(i) ITR.

For CCA class 14, the custom question Is one of the properties an accelerated investment incentive property, as defined under subsection 1104(4) ITR? allows you to indicate if one of the properties qualifies for the increased CCA. When the answer to the question is “Yes,” and the date of acquisition is after November 20, 2018, the amount entered on line 225, Cost of additions of AIIP included in the amount on line 203, is calculated and equals the amount on line 203, Current-year additions. The latter is then used to calculate the amount on the line Maximum allowable CCA taking into account clause 1100(1)(c)(i)(A) ITR.

These calculations also apply to amounts in the Alberta column when the corporation has a permanent establishment in this province. Similarly, they also apply to the amounts in the Québec column, except for property in CCA classes 14.1, 44 and 50, acquired after December 3, 2018, that are properties qualified for the accelerated depreciation special rules in Québec.

Note: To comply with the filing requirements for a corporation tax return, line 211, 1/2 of net additions, will only be calculated when the corporation’s taxation year ends before November 21, 2018. Otherwise, the lines Proceeds of disposition available to reduce the UCC of AIIP, Net capital cost additions of AIIP acquired during the year, UCC adjustment for AIIP acquired during the year, and 224, UCC adjustment for non-AIIP acquired during the year will be calculated.

Property qualifying for accelerated depreciation special rules in Québec

In the Information Bulletin 2018-9, published on December 3, 2018, the Government of Québec announced the harmonization with the measures for the AIIP announced by the federal Government. In addition, it announced the increase to 100% of the depreciation for a property, acquired and available for use after December 3, 2018, that is qualified intellectual property or general-purpose electronic data processing equipment. For qualified property acquired and available for use in the taxation year, the CCA is equal to the capital cost of the acquired property.

A qualified intellectual property means property part of CCA class 14, 14,1 or 44, acquired after December 3, 2018, that is a patent or a right to use patented information, a licence, a permit, know-how, a commercial secret or other similar property constituting knowledge. The property must be acquired by the corporation in the course of a technology transfer or be developed by or on behalf of the corporation with a view to enabling the implementation of an innovation or invention with regards to its business. The expression “technology transfer” refers to the transmission, to a corporation, of knowledge in the form of know-how, techniques, processes or formulas. The process of implementing an innovation or invention as well as the implementation efforts of that innovation or invention must be made only in Québec.

General-purpose electronic data processing equipment and systems software for that equipment means property included in CCA class 50, acquired and available for use after December 3, 2018, that is used primarily in Québec in the course of carrying on a business.

Calculation of line Maximum allowable CCA in the Québec column

For CCA classes 14.1, 44 and 50, the custom line Capital cost of property qualified for the accelerated depreciation special rules in Québec included in the amount on line 203 allows you to enter the capital cost of qualified property. This line is used to calculate the amount to add to the line UCC balance for CCA calculation, according to the CCA class selected, and as a result, taking into account the rules for the calculation of the amount on the line Maximum allowable CCA. When the corporation’s taxation year starts after November 20, 2018, and CCA class 50 is selected, the amount on this line is calculated and equals the amount on line 203, Additions (property subject to subsection 1100(2) ITR).

For CCA class 14, the custom question Is one of the properties acquired during the year a property that qualifies for the accelerated depreciation special rules in Québec? is used to indicate if one of the properties acquired qualifies for the increased CCA. If the answer to this question is “Yes,” and the acquisition date is after December 3, 2018, the amount entered on custom line Capital cost of property qualified for the accelerated depreciation special rules in Québec included in the amount on line 203 is calculated and equals the amount on the line Current-year additions. This amount is then used to calculate the amount on the line Maximum allowable CCA.

Additional Capital Cost Allowance for Québec (CCA classes 50 and 53)

Additional Capital Cost Allowance for Québec (CCA classes 50 and 53)

This section of the form is used to calculate the additional CCA amounts for qualified property in CCA classes 50 and 53. It includes two subsections:

- Additional CCA of 35%, for qualified property acquired after March 28, 2017, and before March 28, 2018, that became available for use in the current or preceding taxation year; and

- Additional CCA of 60%, for qualified property acquired after March 27, 2018, and before December 4, 2018, (or acquired after December 3, 2018, and before July 1, 2019, in accordance with an obligation in writing entered into before December 4, 2018, or for which the construction by or on behalf of the taxpayer began before December 4, 2018) that became available for use in the current or preceding taxation year.

Calculation of the amounts on lines “Half of the capital cost of qualified property that became available for use in the current taxation year” and “Capital cost of qualified property acquired in the current taxation year”

The amounts entered on these lines are calculated in the following situations:

- When information relating to qualified property is entered on copies of Schedule 8 WORKCHART ADD, Additions and Dispositions Workchart (Jump Code: 8 WORKCHART ADD) of an eligible class:

- If the acquisition date is after March 28, 2017, and before March 28, 2018, and is part of the corporation’s taxation year, the amount on the line Half of the capital cost of qualified property that became available for use in the current taxation year of subsection Additional CCA of 35%, will be equal to the total of 50% of the amounts entered on the line Adjusted capital cost – Québec in each copy of Schedule 8 WORKCHART ADD.

- The same calculation, if the acquisition date is after March 27, 2018, and before November 21, 2018 and is part of the corporation’s taxation year, will be performed on the line Half of the capital cost of qualified property that became available for use in the current taxation year in the Qualified property that was acquired after March 27, 2018, and before November 21, 2018 subsection under Additional CCA of 60%.

However, if the acquisition date is after November 20, 2018, and before December 4, 2018, and the CCA class is not a separate class for Québec, the following calculations will be performed in the Additional CCA of 60% - Qualified property that was acquired after November 20, 2018, and before December 4, 2018 section:

the amount on the line Capital cost of qualified property acquired in the current taxation year before December 4, 2018 that are not AIIP is equal to the total of the amounts entered on the line Adjusted capital cost – Québec in each copy of Schedule 8 WORKCHART ADD for property designated as not being an AIIP.

the amount on the line Capital cost of qualified property acquired in the current taxation year before December 4, 2018 that are AIIP is equal to the total of the amounts entered on the line Adjusted capital cost – Québec in each copy of Schedule 8 WORKCHART ADD for property designated as being an AIIP.

- When the amount on line 203, Additions (property subject to subsection 1100(2) ITR), is not calculated (because the property included in the class is not entered on copies of Schedule 8 WORKCHART ADD) and an amount is manually entered on that line:

if the taxation year begins after March 28, 2017, but before March 28, 2018, the amount on the line Half of the capital cost of qualified property that became available for use in the current taxation year of subsection Additional CCA of 35% will be equal to 50% of the amount entered on line 203, Additions (property subject to subsection 1100(2) ITR);

- if the taxation year includes March 28, 2018, a diagnostic will prompt you to enter an amount representing half of the capital cost corresponding to property acquired after March 27, 2018, and before November 21, 2018 and that became available for use in the current taxation year, on the line Half of the capital cost of qualified property that became available for use in the current taxation year in part Qualified property that was acquired after March 27, 2018, and before November 21, 2018 of subsection Additional CCA of 60% (the amount entered will then be automatically deducted from the amount in subsection Additional CCA of 35%);

- if the taxation year includes November 21, 2018, a diagnostic will prompt you to enter the capital cost amount corresponding to the property that was acquired after November 20, 2018, and before December 4, 2018, on one of the four lines in the Additional CCA of 60% - Qualified property that was acquired after November 20, 2018, and before December 4, 2018 subsection (50% of the amount entered will then be automatically deducted from the amount in subsection Additional CCA of 35%).

In all aforementioned cases, the answer to the question Does this class include property eligible for the additional capital cost allowance for Québec? is Yes. In all other cases, the answer will be Yes when you enter an amount on any line in the Additional capital cost allowance (CCA) for Québec section based on the corporation’s situation because the program cannot determine the acquisition date or the relevant capital cost for property eligible for the additional CCA for Québec.

Calculation of the lines “UCC of qualified property that became available for use in the preceding taxation year”

The amounts entered on these lines are calculated when rolling forward a client file in which an amount is entered on the line Half of the capital cost of qualified property that became available for use in the current taxation year and for qualified property that was acquired after March 27, 2018, and before November 21, 2018, or for qualified property that was acquired after November 20, 2018, and before December 4, 2018, on one of the four lines in the Additional CCA of 60% - Qualified property that was acquired after November 20, 2018, and before December 4, 2018 section. The amount will be calculated according to the data entered on the line Half of the capital cost of qualified property that became available for use in the current taxation year or Amount added to the UCC attributable to qualified property, in proportion to the amounts in the fields CCA claimed (amount on line 217) and UCC in the class before CCA.

Additional CCA of 30% in Québec

Additional CCA of 30% in Québec

In the Information Bulletin 2018-9 published on December 3, 2018, the Ministère des Finances du Québec announced that an additional capital cost allowance of 30% would be added for targeted property. The CCA amount corresponds to 30% of the amount deducted, for the previous taxation year, relating to the CCA with respect to targeted property. In addition, the Information Bulletin indicates that a separate class must be created for property of a same class that gives rise to the additional CCA.

Targeted property

Targeted property must be acquired after December 3, 2018. It can be property that is new at the time of its acquisition by the corporation and not property acquired from a person or partnership with which the corporation is not dealing at arm’s length. It must start being used within a reasonable period of time after being acquired and for at least 730 consecutive days. In addition, it must be used primarily in Québec and must not be property with regards to which the corporation was entitled to or could have been entitled to claim the additional capital cost allowance of 60%. The property must be:

- equipment used in manufacturing or processing (class 53) or, if acquired after 2025, property included in class 43, but that would have been included in class 53 had it been acquired in 2025;

- clean energy generation equipment (class 43.1 or 43.2); or

- general-purpose electronic data processing equipment and related operating system software (class 50).

In addition, a targeted property can be a qualified intellectual property (certain property in classes 14, 14.1 and 44).

The program considers that property included in classes 14, 14.1, 43.1, 43.2, 44, 50 and 53 acquired after December 3, 2018, is targeted property. If this is not the case, modify the answer to the question Is the property a property that qualifies for the additional CCA of 30% in Québec? in Schedule 8 WORKCHART ADD (Jump Code: 8 WORKCHART ADD). If you are not using Schedule 8 WORKCHART ADD, make the required adjustments in the Schedule 8 WORKCHART. For more details on eligible properties, consult the Information Bulletin 2018-9 published by the Ministère des Finances du Québec.

Steps to follow in order for the program to correctly calculate the CCA and the additional CCA in respect of targeted property

The question Is this a separate class used solely for the Québec income tax return and relating to prescribed property qualifying for the additional CCA of 30%?, located under the field “If yes, specify the property to be linked in order to transfer data” for classes 14.1, 43.1, 43.2, 44, 50 and 53, and in subsection “Québec only” located under subsection “Current-year additions” for a class 14, allows you to indicate if the class is a separate class for purposes of Québec calculations. The question Are properties entered in the Québec column eligible for the additional CCA of 30%? located under the question Is this a separate class used solely for the Québec income tax return and relating to prescribed property qualifying for the additional CCA of 30%? allows you to indicate if the CCA calculated for this class must be used the following year to calculate the additional CCA. Follow the instructions below in order for the program to correctly perform the calculations based on the corporation’s situation:

Situation number 1: All properties in the class are not targeted properties

If Schedule 8 WORKCHART ADD is used: No separate class is required, and the corporation is not entitled to the additional CCA. Create only one class and make sure that the answer to the question Is the property a property that qualifies for the additional CCA of 30% in Québec? determined by the program is “No” for all copies of Schedule 8 WORKCHART ADD of the class. Make sure that the answer to the questions Is this a separate class used solely for the Québec income tax return and relating to prescribed property qualifying for the additional CCA of 30%? and Are properties entered in the Québec column eligible for the additional CCA of 30%? in Schedule 8 WORKCHART is “No.”

If Schedule 8 WORKCHART ADD is not used: No separate class is required, and the corporation is not entitled to the additional CCA. Create only one class and make sure that the answer to the questions Is this a separate class used solely for the Québec income tax return and relating to prescribed property qualifying for the additional CCA of 30%? and Are properties entered in the Québec column eligible for the additional CCA of 30%? in Schedule 8 WORKCHART is “No.”

Situation number 2: All properties in the class are targeted properties

If Schedule 8 WORKCHART ADD is used: No separate class is required, and the corporation is entitled to the additional CCA for targeted property. Create only one class and make sure that the answer to the question Is the property a property that qualifies for the additional CCA of 30% in Québec? determined by the program is “Yes” for all copies of Schedule 8 WORKCHART ADD of the class. Therefore, the answer to the question Are properties entered in the Québec column eligible for the additional CCA of 30%? in Schedule 8 WORKCHART will be “Yes.” Make sure that the answer to the question Is this a separate class used solely for the Québec income tax return and relating to prescribed property qualifying for the additional CCA of 30%? in Schedule 8 WORKCHART is “No.” The program will use the CCA amount claimed on line 217 of the Québec column to calculate the additional CCA when rolling forward the client file.

If Schedule 8 WORKCHART ADD is not used: No separate class is required, and the corporation is entitled to the additional CCA for targeted property. Create only one class and make sure that the answer to the question Are properties entered in the Québec column eligible for the additional CCA of 30%? of Schedule 8 WORKCHART is “Yes.” Make sure that the answer to the question Is this a separate class used solely for the Québec income tax return and relating to prescribed property qualifying for the additional CCA of 30%? in Schedule 8 WORKCHART is “No.” The program will use the CCA amount claimed on line 217 of the Québec column to calculate the additional CCA when rolling forward the client file.

Situation number 3: The class contains targeted and non-targeted property

If Schedule 8 WORKCHART ADD is used: A separate class for purposes of the Québec calculations is required for targeted property, and the corporation is entitled to the additional CCA for targeted property. In a class, enter all properties in Schedule 8 WORKCHART ADD and make sure that the answer to the question Is the property a property that qualifies for the additional CCA of 30% in Québec? determined by the program is the correct one based on whether the property is targeted or not. Make sure that the answer to the questions Is this a separate class used solely for the Québec income tax return and relating to prescribed property qualifying for the additional CCA of 30%? and Are properties entered in the Québec column eligible for the additional CCA of 30%? in Schedule 8 WORKCHART is “No.” In that situation, all amounts for properties entered in Schedule 8 WORKCHART ADD will be transferred to the Federal and Alberta columns of Schedule 8 WORKCHART. Only the amounts for non-targeted property will be transferred to the Québec column. Then, create a new class, answer “Yes” to the question Is this a separate class used solely for the Québec income tax return and relating to prescribed property qualifying for the additional CCA of 30%? in Schedule 8 WORKCHART and enter only targeted property in Schedule 8 WORKCHART ADD. Make sure that the answer to the question Is the property a property that qualifies for the additional CCA of 30% in Québec? determined by the program is “Yes” for all copies of Schedule 8 WORKCHART ADD of this class. Make sure that the answer to the question Are properties entered in the Québec column eligible for the additional CCA of 30%? of Schedule 8 WORKCHART is “Yes.” The amounts in the Federal and Alberta columns of Schedule 8 WORKCHART will not be calculated for this copy of the class, and no amount should be entered in these columns. Only the amounts in respect of targeted property must be entered in the Québec column. The program will use the CCA amount claimed on line 217 of the Québec column to calculate the additional CCA when rolling forward the client file.

If Schedule 8 WORKCHART ADD is not used: A separate class for purposes of Québec calculations is required for targeted property, and the corporation is entitled to the additional CCA for targeted property. In a class, enter the amounts relating to targeted and non-targeted property in the Federal column of Schedule 8 WORKCHART. Make sure that the answer to the questions Is this a separate class used solely for the Québec income tax return and relating to prescribed property qualifying for the additional CCA of 30%? and Are properties entered in the Québec column eligible for the additional CCA of 30%? in Schedule 8 WORKCHART is “No.” In the Québec column of Schedule 8 WORKCHART, enter only the amounts relating to non-targeted property, using an override. Then, create a new class, answer “Yes” to the questions Is this a separate class used solely for the Québec income tax return and relating to prescribed property qualifying for the additional CCA of 30%? and Are properties entered in the Québec column eligible for the additional CCA of 30%? in Schedule 8 WORKCHART and enter only the amounts relating to targeted property in the Québec column. The amounts in the Federal and Alberta columns of Schedule 8 WORKCHART will not be calculated for this copy of the class, and no amount should be entered in these columns. The program will use the CCA amount claimed on line 217 of the Québec column to calculate the additional CCA when rolling forward the client file.

See also

Additions

and Dispositions Workchart and Class Property History Table

Statement

Real Estate Rental Properties (Regulation 1100(11))

Leasehold

Interests (Class 13)

Patents,

Franchises, Concessions and Licences for a Limited Period (Class 14)

Prior

Year Leasehold Additions

Passenger

Vehicles (Class 10.1)

T2 Corporation – Income Tax Guide

CO-130.A

- General Information

IN-191, Capital Cost Allowance in Respect of Property Acquired After November 20, 2018

![]() button, the CCA classes will appear in an ascending order on their class number, both on screen and when printing. If the same class number is found twice or more, a second sort will automatically be performed: items from a same category will be classified in alphabetical order according to information in the Description column. When adding classes, you will have to repeat the process to sort them. In addition, when you click the second

button, the CCA classes will appear in an ascending order on their class number, both on screen and when printing. If the same class number is found twice or more, a second sort will automatically be performed: items from a same category will be classified in alphabetical order according to information in the Description column. When adding classes, you will have to repeat the process to sort them. In addition, when you click the second ![]() button, the CCA classes will appear in an ascending order on their capital cost allowance (CCA) rate, both on screen and when printing. If the same CCA rate is found twice or more, a second sort will automatically be performed: items from a same CCA rate will be classified in an ascending on their Class number column. If the same class number is found twice or more, a third sort will automatically be performed: items from a same category will be classified in alphabetical order according to information in the Description column. When adding classes, you will have to repeat the process to sort them.

button, the CCA classes will appear in an ascending order on their capital cost allowance (CCA) rate, both on screen and when printing. If the same CCA rate is found twice or more, a second sort will automatically be performed: items from a same CCA rate will be classified in an ascending on their Class number column. If the same class number is found twice or more, a third sort will automatically be performed: items from a same category will be classified in alphabetical order according to information in the Description column. When adding classes, you will have to repeat the process to sort them.![]() buttons will also be on the Forms CO-130.A, Capital Cost Allowance (Jump Code: Q8) and the Alberta Schedule 13, Capital Cost Allowance (Jump Code: A13). Any sort requested from one of these three forms will automatically be applied to the two other forms.

buttons will also be on the Forms CO-130.A, Capital Cost Allowance (Jump Code: Q8) and the Alberta Schedule 13, Capital Cost Allowance (Jump Code: A13). Any sort requested from one of these three forms will automatically be applied to the two other forms.

![]() Eligible capital property (Class 14.1)

Eligible capital property (Class 14.1)

![]() Classes 54, 55 and 56 (zero-emission equipment and vehicles)

Classes 54, 55 and 56 (zero-emission equipment and vehicles)

![]() Property qualified for accelerated depreciation

Property qualified for accelerated depreciation

![]() Additional Capital Cost Allowance for Québec (CCA classes 50 and 53)

Additional Capital Cost Allowance for Québec (CCA classes 50 and 53)

![]() Additional CCA of 30% in Québec

Additional CCA of 30% in Québec