Synchronizing linked corporations

For two linked corporations to be synchronized, the tax data that you want to synchronize in the copy of the S9 Workchart schedule of the active return and in its source return must be identical.

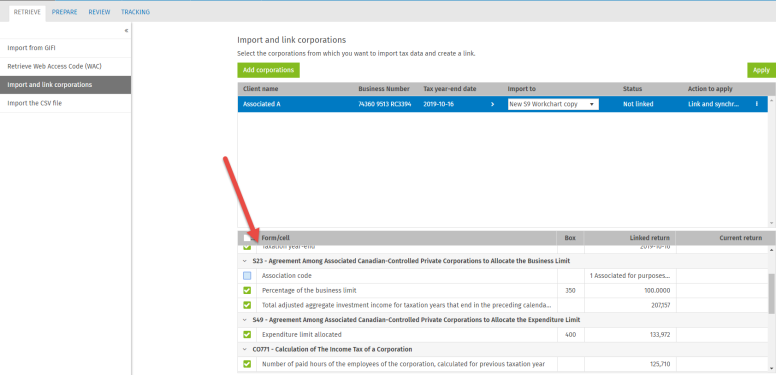

Selecting tax data to synchronize

You can determine the tax data that you want to synchronize from the grid to select the tax data to import and synchronize.

The selected boxes are tied to values. If you clear a box, the value tied to the former will not be included in the synchronization. For example, if you clear the Percentage of the business limit check box and you thereafter modify its value, the two corporations will still be considered as synchronized, but you will have excluded this value from synchronization.

Copy of the S9 Workchart schedule that is not synchronized

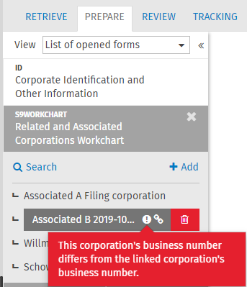

When a copy of the S9 Workchart schedule contains tax data that is not synchronized, a warning icon  displays.

displays.

Where the business number, calendar year and/or taxation year differ, the icon  displays and a message appears when you place your cursor on the icon.

displays and a message appears when you place your cursor on the icon.

Status of the S9 Workchart schedule

To verify whether one or more linked copies of the S9 Workchart schedule are not synchronized, click the refresh button next to the status.

The status of the S9 Workchart schedule only displays if there is at least one copy of the S9 Workchart schedule linked to a source return. The statuses of the S9 Workchart schedule are the following:

|

Status |

Description |

|

Synchronized |

The S9 Workchart schedule is synchronized if all linked copies of the S9 Workchart schedule are synchronized. |

|

Not synchronized |

The S9 Workchart schedule is not synchronized if at least one linked copy of the S9 Workchart schedule is not synchronized. |

Synchronize the linked copies of the S9 Workchart schedule

Three ways of synchronizing the linked copies of the S9 Workchart schedule are available in the application:

- Importing by applying the Synchronize action. This is advantageous if you modified many data items in your source returns and you want their values to be used in the linked copies of your active return.

- Exporting. This is advantageous if you modified many data items in your linked copies of the S9 Workchart schedule of your active return and that you want this data to be used in their source return.

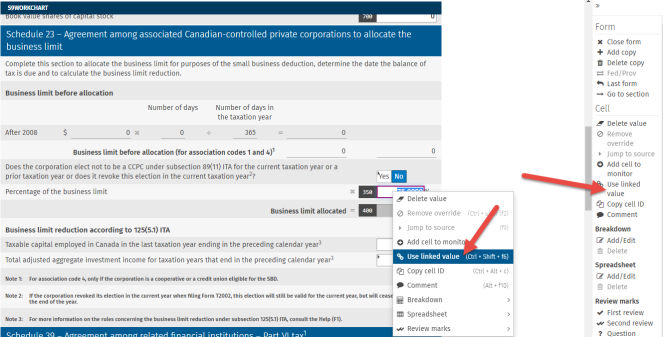

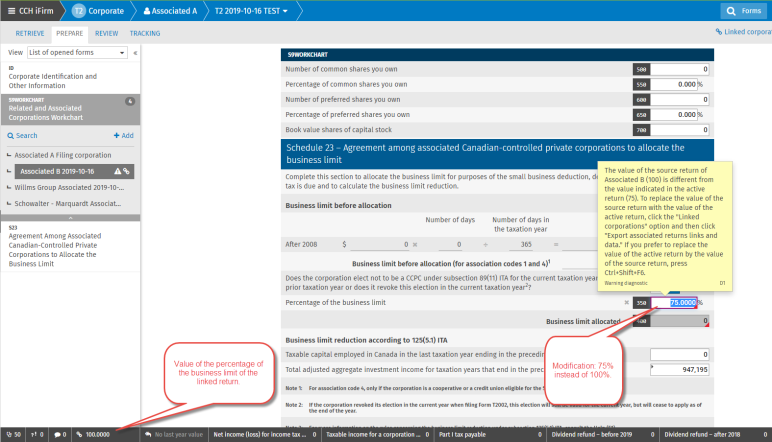

- By using the contextual menu or the option “Use the linked value” in the left pane. If two of your linked returns are no longer synchronized because, for example, you modified the percentage of the business limit, you are not required to go ahead with the import or export to synchronize them.

Note that the monitor provides you with the value of the cell in the linked source return.

In addition, the source returns of each linked corporation are used to validate the values of the active return. However, if the value indicated in the active return differs from that entered in the source return, diagnostics will advise you of the situation. See the example above.

To synchronize them:

- Place your cursor on the percentage of the business limit cell, then right-click.

- Click the Use the linked value option in the contextual menu or in the left pane or use the Ctrl+Shift+F6.