T661 Part 2, Project Information

You must complete a copy of Form T661 - Part 2, Project Information (Jump Code: 661 PART 2), for each completed SR&ED project.

Project costs (details of lines 750 to 758)

Information requested in this part must be provided for all SR&ED projects claimed in the year. Expenditures should be recorded and allocated on a project basis. To facilitate the data entry and follow up per project, this information has been grouped in the “Project costs” section of Form T661 Part 2 in order to be linked to a specific copy of Form T661 Part 2. This way, each project will have its own copy and applicability.

Inactive project

Note that the expenditure lines 752, 754,756 and 758 must be left blank for an inactive project. The copy of the form will be considered as not applicable and the information relating to the project concerned will not be transmitted with the tax return. Therefore, no diagnostic will be displayed for the project.

Note that data in this section will be displayed in the table of Part 6 of Form T661.

Because it is still possible to continue submitting the information related to Part 2 projects solely for the 20 most important projects in terms of dollar value, i.e., for an indefinite period, the following question was added:

If your claim affects more than 20 projects, do you wish to submit the information related to the projects (lines 200 to 282 of Form T661 Part 2) solely for the 20 most important projects in terms of dollar value?

The answer to this question will default to No. If you answer Yes to this question, the program will automatically select the 20 most important projects in terms of dollar value in each copy of Form T661 Part 2. The ones that will be included will be marked as Applicable in Part 6 as well as on the specific copy of Part 2 for that project and only the information in Part 2 related to those projects will be submitted to the CRA.

If a project is not applicable, then no diagnostics will be generated if there are project details missing in Part 2 (other than project costs).

If there are less than 20 projects entered, then all projects will automatically be applicable.

Previously, the program allowed you to enter only information for projects that had to be submitted. For example, when the election to submit the 20 most important projects was made, it was not possible to include the other projects in the client file without having to submit them to the Ministry. With this question, the other projects can be completed (all or in part) and the information can be retained in the client file for the taxation year affected by the SR&ED claim. Therefore, at the request of the Ministry, the information on the projects concerned can be entered using the program and submitted to the CRA, while complying with the corporations’ respective taxation years.

Line Cost of the project in terms of dollar value

This represents the total from lines 752, 754, 756 and 758. Since the definition of the term “dollar value” does not exist, we will use this value to choose the 20 most important projects when the applicable box is selected (see the new question in Part 2). When these choices for a given project are not convenient, it will be possible to modify at all times the value for the cost of the project accordingly in order for this cost to be retained. Note that this information is not submitted to the CRA and will not print on the paper copy.

Inactive project

Note that the expenditure lines 752, 754, 756 and 758 must be left blank for an inactive project.

Alberta Innovation Employment Grant

When the scientific research and experimental development (SR&ED) expenses are incurred in Alberta in the taxation year after December 31, 2020, specify when these expenses were incurred by selecting the check box After December 31, 2020 or After December 31, 2020, and before January 1, 2021, as the case may be. In both situations, these check boxes allow you to update the title (line 200) and the code (line 206) of the project to Form AT1 Schedule 29 LISTING, which you will then have to complete. If the check box After December 31, 2020, and before January 1, 2021 is selected, two lines will be created in the form and will have to be completed.

Please note that if you decide to avail yourself of the election to submit the 20 most important projects, you must complete line 206, for all projects (and not solely for the 20 most important projects) in order for this information to be carried forward to Form AT1 Schedule 29 LISTING.

Inactive project

The copy of the form will be considered as not applicable and the information relating to the project concerned will not be transmitted with the tax return. Therefore, no diagnostic will be displayed for the project.

Check box Applicability for purposes of Form T661 Part 2

An “X” in the check box will indicate that the information on this project (a copy of Form T661 Part 2) will be submitted to the Ministry and will enable the diagnostics based on which the information required on the project must be entered (lines 200 to 282). Note that this information is not submitted to the CRA and will not print on the paper copy.

When the check box for a given project is not selected, no diagnostic will display for this copy (lines 200 to 282), except those for the “Project costs” section (with reference to lines 750 to 756 in Part 6). Therefore, part or all of the project information can be entered for a given project not selected when electing the 20 most important projects and the information can be retained in the client file of the taxation year affected by the SR&ED claim.

When the election of the 20 projects is not made (or is made, but you have less than 20 projects), all of the projects will automatically become applicable.

Inactive project

The copy of the form will be considered as not applicable and the information relating to the project concerned will not be transmitted with the tax return. Therefore, no diagnostic will be displayed for the project.

Section B lines 242, 244 and 246

Note that the text you can input on lines 242, 244, 246 in Section B is limited to 50 or 100 lines, as applicable. Each line can contain a maximum of 78 characters. The program will advise you when you reach this limit. If applicable, you will have to reduce your text accordingly since you cannot add supplementary notes on paper format.

Note that this information can be taken from another application, such as a word processing program (e.g. Word) and using the Copy and Paste commands, it can be exported into the applicable sections of the form.

Print only

A check box allow you to not print the project description indicated on lines 242, 244 and 246 when printing a copy of Form T661 Part 2. The program selects this box by default on all copies of this form when the corresponding box is selected in Part 2 of Form T661. However, this choice can be modified on each of these copies for a particular project.

When this box is selected, the content of lines 242, 244 and 246 will be replaced when printing by the following sentence: “You have chosen not to print the description of the project (lines 242, 244 and 246).” The status (selected or cleared) of this new check box will be retained during roll forward.

This print option has no impact on data transmitted to the CRA via the Internet or in a T2 - Bar Codes return, or on the copies of Form T661 Part 2 that accompany the Québec tax return. However, to preserve the confidentiality of the project data, you can select Never in the Print when? column for the copies of Form T661 Part 2 intended for Revenu Québec in the “Client,” “Office,” or in your customized print formats.

Rolling forward data from one taxation year to the other

Line 204 – Completion or expected completion date

For the purpose of rolling forward a client file, only the projects ending after the taxation year end date are rolled forward. When the copy of Form T661 Part 2 of a given project is not applicable, it is therefore important to complete line 204.

When the date is unknown, it is better to estimate an expected date following the end date of the taxation year in order to trigger the roll forward rules.

Inactive project

When rolling forward the client file, the project information will be retained in the same manner as if the project had been active, regardless of the date entered on line 204. Therefore, the information will be rolled forward as long as the project is not terminated.

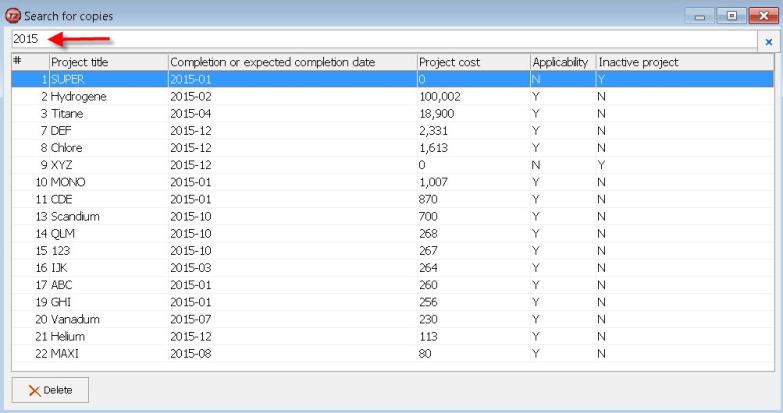

Searching the Project List

When you click the Search button

at the top of the T661 Part 2, you can search for specific projects

by number, completion date, total cost in addition to searching by Project

title.

The list will also indicate whether or not the project is currently applicable or not and if the project is active or not.

Once you have located the desired project, double-click on it to open that specific copy of the T661 Part 2.

Search box of line 206

To facilitate the selection of the appropriate code, you can display a search box by clicking the ellipsis points of the data entry cell or by using the Alt+Down arrow shortcut.

For the list of field of science or technology codes, see the Guide to form T661 (SR&ED).

See also

T661, Scientific Research & Experimental Development Expenditures