T661, Scientific Research & Experimental Development Expenditures

Contributions paid to agricultural organizations for SR&ED

Agricultural producers are not required to complete Form T661 with regard to contributions paid to agricultural organizations for SR&ED. Therefore, custom lines have been added to allow you to input this information for the purpose of claiming the investment tax credit at Schedule 31 (Jump Code: 31), Part 8 line 350, Qualified SR&ED expenditures (including contributions to agricultural organizations for SR&ED).

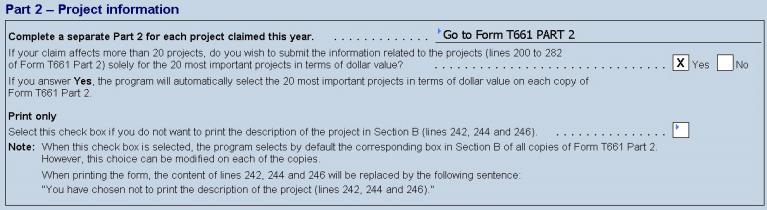

Part 2 – Project information

If you have more than 20 SR&ED projects, you can continue to provide the project details for only the 20 largest projects. However, you will be required to provide the costs for each project.

If you want to submit only the details for the 20 largest projects, then answer Yes to the following question on the T661:

The program will automatically determine which projects constitute the largest 20 projects. The ones that will be included will be marked as Applicable in Part 6 as well as on the specific copy of Part 2 for that project.

The answer to this question will default to No. When this question is answered Yes, then only the details of the 20 largest projects will be included in the T2 Bar Codes or the EFILE transmission file.

This will allow you to collect the required project cost information yet still only provide the project details for the top 20 projects.

Inactive project

When a project is inactive, the copy of the form will be considered as not applicable and the information relating to the project concerned will not be transmitted with the tax return.

Print only

A check box allow you to not print the project description indicated on lines 242, 244 and 246 when printing a copy of Form T661 Part 2. When this box is selected, the content of lines 242, 244 and 246 will be replaced when printing by the following sentence: “You have chosen not to print the description of the project (lines 242, 244 and 246).”

Note that when this box is selected, the program selects by default the corresponding box, which we have also added on all copies of Form T661 Part 2. However, this choice can be modified on each of these copies for a particular project. The status (selected or cleared) of this new check box will be retained during roll forward.

This print option has no impact on information transmitted to the CRA via the Internet or in a T2 - Bar Codes return, or on the copies of Form T661 Part 2 that accompany the Québec tax return. However, to preserve the confidentiality of the project information, you can select Never in the Print when? column for the copies of Form T661 Part 2 intended for Revenu Québec in the “Client,” “Office,” or in your customized print formats.

SR&ED salary or wages for work performed outside Canada - lines 307 and 309

The claimant that qualifies for SR&ED activities can receive an investment tax credit (ITC) on SR&ED salary or wages eligible for work performed outside of Canada after February 25, 2008. SR&ED activities performed outside of Canada must be performed directly by employees of the claimant and those activities must be an integral part of the SR&ED activities performed in Canada by the claimant.

Eligible salary or wages incurred by a claimant in a taxation year are limited to 10% of the total salary or wages for SR&ED performed in Canada. These salary or wages are also eligible for the calculation of the prescribed proxy amount when the proxy method is used (see Part 5 of Form 661).

Consult the guide T661 Scientific Research and Experimental Development (SR&ED) Expenditures Claim for more details and to be able to calculate the eligible salary or wages on lines 307 and 309.

Third-party payments – line 370

You must complete a copy of Form T1263 – Third-party Payments for SR&ED (Jump Code: 661(T1263)), for each payment made to a third-party for SR&ED.

When the research development and experimental development (SR&ED) expenses are incurred in Alberta, check boxes allow you to update the name of the third party (line 701) to Form AT1 Schedule 29 LISTING, which you will then have to complete.

Provincial government assistance custom section – lines 429a to 429d and 513a to 513d

The program calculates the various SR&ED tax credits claimed in Québec, Ontario, British Columbia and Alberta. You should calculate and enter any other provincial tax credit on lines 429e and 513e, if applicable.

Provincial government assistance for SR&ED expenses – lines 429d and 513d

To ensure that the program is correctly calculating the amounts in respect of provincial government assistance for SR&ED expenses, proceed as follows:

Step 1: Complete Form T661.

Step 2: Complete the applicable provincial research and development tax credit schedules, but do not enter any amount of government assistance, non-government assistance or contracts payments.

Step 3: Enter the provincial tax credit amounts that are not calculated by the program for the eligible expenditures in Part 4 of Form T661, lines 429e and 513e.

Step 4: Enter the amounts of government assistance, non-government assistance or contracts payments on the applicable provincial research and development tax credit schedules.

Step 5: Repeat steps 3 and 4.

Step 6: Repeat step 5 until the results stay unchanged to the nearest dollar.

Québec Credit for SR&ED

The Québec credit for scientific research and experimental development is a taxable item for federal income tax purposes. Since the Québec credit is in essence a form of government assistance on SR&ED, the credit automatically updates federal form T661 as a reduction of federal SR&ED expenditures.

Prescribed proxy amount (PPA) – (line 502, Part 4) and overall cap on the prescribed proxy amount covered by the regulation – (line 820 Part 5)

The prescribed proxy amount covered by the regulation normally corresponds to 55% of the total eligible portion of salary or wages of employees directly engaged in SR&ED activities in Canada. The program calculates this amount from data in Part 5. The amount calculated on line 820 in Section B is then posted to line 502 in Part 4.

The amount that you can claim on line 502 corresponds to the amount on line 820, except if the overall cap on PPA that you will have calculated is lower than the amount on line 820.

Furthermore, the amount that you can claim on line 502 is limited to the overall cap on PPA calculated manually, i.e., the business expenses minus certain specific deductions, such as rent for a building, capital allowances, and interest expenses.

See the T661 form’s guide for an explanation on the overall cap calculation on PPA.

Please note that the program is not able to calculate the limit based on the maximum overall cap on PPA. If the overall cap on PPA calculated manually is lower than the amount calculated by the program on line 820, you must override, on line 502 in Part 4, the overall cap on PPA calculated manually.

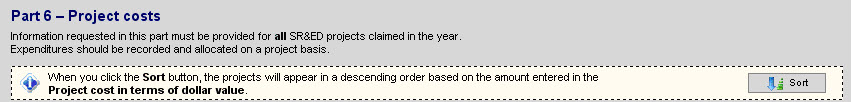

Part 6 – Project costs (details of lines 750 to 758)

Information requested in this part must be provided for all SR&ED projects claimed in the year. Expenditures should be recorded and allocated on a project basis. In order to facilitate the capture and follow up per project, this information has been grouped for data entry the “Project costs” section of Form T661 Part 2 – Project information in order for this information to be linked to a specific copy of Form T661 Part 2. This way, each project will have its own copy and applicability.

Two columns were added to this table:

- Column Cost of the project in terms of dollar value: this represents the total from lines 752, 754, 756 and 758. Since the definition of the term “dollar value” does not exist, we will use this value to choose the 20 most important projects when the applicable box is selected (see the question in Part 2). When these choices for a given project are not convenient, it will be possible to modify at all times the value for the cost of the project accordingly in order for this cost to be retained. Note that this information is not submitted to the CRA and will not print on the paper copy.

- Column Applicability for purposes of Form T661 Part 2: a check box, which will be selected in this column, will indicate that the information on this project (a copy of Form T661 Part 2) will be submitted to the Ministry and will enable the diagnostics based on which the information required on the project must be entered (lines 200 to 282). Note that this information is not submitted to the CRA and will not print on the paper copy.

Note: Use the File/Print Form command and select the checkbox Print as displayed in order to print a copy of this table that includes the Total Cost and Applicability columns.

When the check box for a given project is not selected, no diagnostic will display for this copy (lines 200 to 282), except those for the “Project costs” section (with reference to lines 750 to 758 in Part 6). Therefore, part or all of the project information can be entered for a given project not selected when electing the 20 most important projects and the information can be retained in the client file of the taxation year affected by the SR&ED claim.

When the election of the 20 projects is not made (or is made, but you have less than 20 projects), all of the projects will automatically become applicable.

Inactive project

When a project is inactive, the copy of the form will be considered as not applicable and the information relating to the project concerned will not be transmitted with the tax return.

Sorting the Project List

A

![]() button allows you to sort projects in descending order according

to the amount in the column Cost of the

project in terms of dollar value.

button allows you to sort projects in descending order according

to the amount in the column Cost of the

project in terms of dollar value.

With the first sort, the value of the project cost is taken into account, then the applicability. If the same amount is found more than once, the projects with identical costs will be sorted according to alphabetical order in the Project title.

If a new copy (project) is added, the sort must be performed again in order for the program to take this copy into account in descending order.

We suggest you sort only when all data items are entered for all of the projects. Printing of the applicable copies of Form T661 Part 2 will follow the display of projects based on the lines displayed in the table of Part 6.

Part 9 – Claim preparer information

For claim preparers who have concerns about the confidentiality of their information, the CRA has introduced an administrative measure that allows them to file Part 9 of Form T661 separately from the tax return.

If you elect to file the information with regards to claim preparers separately by answering “Yes” to the question Do you want to file Part 9 separately from the tax return?, the fields of lines 950, 955, 960 and 965, i.e. the billing arrangement code, billing rate, other billing arrangement(s) and the total fee paid, payable or expected to be paid, must be left blank on the copy of the T661 form filed with the tax return.

A paper copy of Form T661 with Part 1 duly completed as well as Part 9 fully completed for each claim preparer must be submitted within the prescribed time period to avoid the $1,000 penalty.

You can enter the confidential information from lines 950, 955, 960 and 965 of Part 9 using Form Paper Copy of Form T661, Parts 1 and 9.

This form has been created to allow claim preparers who have concerns with regards to the confidentiality of their information to file, separately from the tax return, a paper copy with only Parts 1 and 9 of Form T661, Scientific Research and Experimental Development (SR&ED) Expenditures Claim (Jump Code: 661), for federal tax purposes. You will find the CRA’s instructions on how to file this information at the beginning of the form, in the “Filing instructions” section.

For more information on the steps to file Parts 1 and 9 of Form T661 separately, consult the CRA Web page, SR&ED T661 Claim Form – Revised optional filing measure for Part 9.

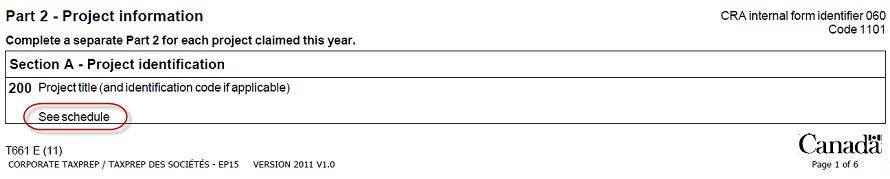

Printing

When a project is not applicable (no Form T661 Part 2 is applicable), Form T661 prints on 8 pages (this can vary depending on the use of the multiple lines area available in certain sections), including pages 2 and 3 detailed for Part 2, which will be empty.

As soon as a project is applicable (at least one copy of Form T661 Part 2 is applicable), Form T661 prints on 6 pages (this can vary depending on the use of the multiple lines area available in certain sections), without pages 2 and 3 detailed for Part 2. However, le text below will display on page 1 for Part 2 as follows:

Form T661 will print with the following text in Part 2 even if there is only one project.

The pages of each of the projects for which the copy of Form T661 Part 2 will be applicable will follow. Each project will be numbered according the related line number of the table in Part 6 and will be printed in the same order as they appear in Part 6.

Note: To print all of the copies of the T661 Part 2, regardless of whether or not the project is considered Applicable (i.e. being submitted as one of the top 20 projects), select the T661 Part 2 from the Form Manager then select File/Print Selected Forms. All copies of the form will be printed.

For Québec purposes

“GOVT RSI, Bar Codes - RDA, code à barres” predefined print format

In accordance with Revenu Québec’s filing requirements, the following federal forms are printed (if they are applicable):

- T661, Scientific Research and Experimental Development (SR&ED) Expenditures Claim (Jump Code: 661)

- Schedule 30 - T1263 – Third-Party Payments for Scientific Research and Experimental Development (SR&ED) (Jump Code: 661 (T1263))

- Schedule 60 - T661 Part 2 – Project Information (Jump Code: 661 PART 2)

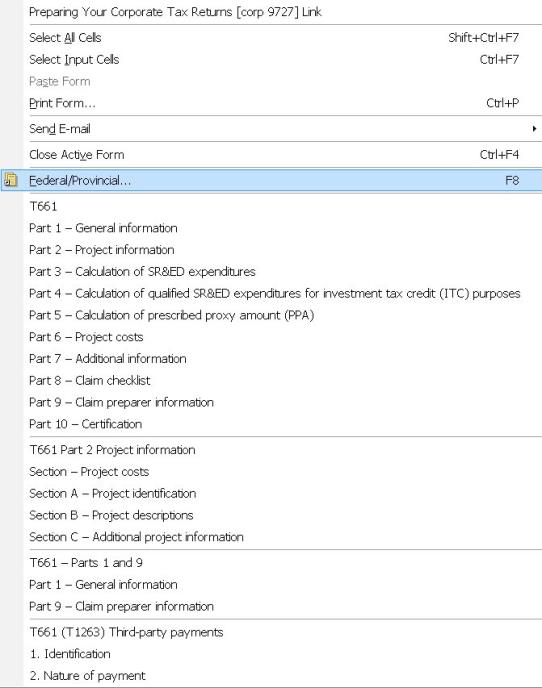

Right-click

Right-click within the forms T661, the T661 Part 2, T661 Parts 1 and 9 or the T661 (T1263) to access any sections from any of these forms.

See also

T661 Part 2 – Project information

Form Paper Copy of Form T661, Parts 1 and 9

T2 Corporation – Income Tax Guide

Summary of Provincial and Territorial Research & Development (R&D) Tax Credits